This transaction alert is now available to all our subscribers — giving you a one-time chance to experience the exclusive insights usually only available for our paid members.

Stefan just added to ASML — one of the world’s most essential tech companies — even as uncertainty rises. Here’s why we believe now is a smart time to buy 👇

Transaction

Stock: ASML (AMS: ASML)

📅 Date: July 16, 2025

👤 Who: Stefan

🔄 Action: Bought

💵 Price: €658.00

🔵 Fund. score: 81 → High-Quality

Yesterday, Stefan increased his position in ASML, the global leader in EUV lithography systems — the machines needed to produce advanced chips. The timing? Right after the company’s Q2 earnings, which beat expectations across the board:

EPS: €5.90 vs €5.24 expected ✅

Revenue: €7.69B vs €7.56B expected ✅

Gross Margin: 53.7% vs 51.7% expected ✅

Bookings: €5.54B vs €4.44B expected ✅

Despite these strong results, ASML’s CEO added a note of caution:

“Although we still expect growth in 2026, we can’t guarantee it at this point.”

This led to a drop of over 10% in ASML’s stock price yesterday.

Importantly, ASML isn’t saying it expects no growth — just that it’s being cautious amid macroeconomic uncertainty. Rising import tariffs are driving up the cost of key materials ASML needs to build its machines. On top of that, potential tariffs on the machines themselves could further inflate prices.

But, ASML’s position remains incredibly strong. Even if prices rise, leading chipmakers like Intel and TSMC — who are investing billions in new fabs in the U.S. — will still depend on ASML’s EUV machines to make next-generation chips. And ASML is the only company in the world that can build these machines.

These machines are critical to modern chip production, and it’s hard to imagine the U.S. — which sees semiconductors as an important strategic industry — taking steps that would make them harder or more expensive to import. Any import tariffs would not only hurt ASML, but also U.S. chipmakers and the broader supply chain.

For this reason we believe the fear around import tariffs may turn out better than expected. This is more about management being careful than a real change in the company’s fundamentals.

💡 Why Stefan Bought

While the rising uncertainty might scare investors, we remain confident in ASML’s long-term path. Why?

Monopoly in EUV

ASML is the only company in the world that can produce EUV machines — essential for making cutting-edge chips. Giants like Intel, TSMC, and Samsung rely on them, especially now they’re building fabs in the U.S. Without the machines from ASML, even Nvidia’s most advanced AI chips can’t be produced.AI is driving long-term growth

We’re still early in the AI cycle. Demand for advanced chips is only going up — and so is demand for ASML’s machines.Strong guidance for 2030

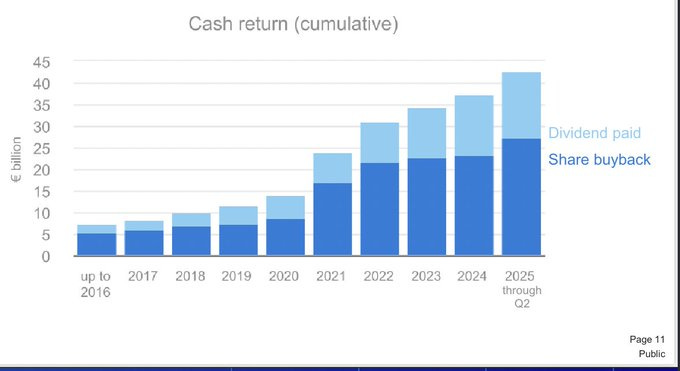

ASML currently generates around €30B in annual revenue, but expects that to grow to €44–60B by 2030, with gross margins rising to 56–60%.Share buybacks show confidence

The company has consistently bought back its own stock — and in just the first two quarters of 2025, it already exceeded its total buybacks for all of 2024. A clear sign of confidence from management.Source: X Profile Investing with Aria

Valuation looks fair

The stock trades at a P/E of 26.6 (NTM), well below its 10-year mean of 31 (source: Koyfin). For a company with a monopoly in EUV machines crucial for the AI future, that’s a multiple we’re happy to pay.

Source: Koyfin

📌 Conclusion

We’re not ignoring the near-term risks, but we believe these will fade over time. ASML’s strategic importance, monopoly position, and long-term growth driven by AI make it a high-conviction stock in our portfolio. At today’s valuation, we see it as a great opportunity to buy a wonderful company at a fair price. If the stock drops further, we won’t hesitate to add more.

Don’t Miss This — 26% Off for Life! 🔥

Unlock full access to everything we offer ✨ and enjoy a lifetime 26% discount on your annual plan. Upgrade today!

Thank you for reading! 🙏

We put a lot of love into creating this post for you. If you enjoyed it, feel free to click the ❤️ button so more people can discover it on Substack or hit the ↪️ share button to share it with friends, family and fellow investors!

Disclaimer:

The transaction updates, information and opinions provided in this article are for informational and educational purposes only and should not be considered as investment advice or a recommendation to buy, sell, or hold any financial product, security, or asset. The Future Investors does not provide personalized investment advice and is not a licensed financial advisor. Always do your own research before making any investment decisions and consult with a qualified financial professional before making any investment decisions. Please consult the general disclaimer for more details.