Every month, we search for great companies trading at a fair price and highlight three stocks that we believe are particularly interesting based on our analysis.

In our selection process, we focus on both strong fundamentals and attractive valuations. However, we firmly believe that it’s better to own a wonderful company at a fair price than a fair company at a wonderful price. That’s why fundamentals carry more weight in our assessment than valuation alone.

Here are our top 3 stocks — that we believe are worth keeping an eye on right now. Especially No. 2 looks like a real bargain right now! 🎯

Disclaimer:

The information and opinions provided in this article are for informational and educational purposes only and should not be considered as investment advice. Please consult the general disclaimer for more details.

#3: LVMH (OTC: LVMUY)

LVMH is the world’s largest luxury group, home to iconic brands like Louis Vuitton, Dior, Moët & Chandon, and TAG Heuer. But it’s more than just prestige. LVMH is a financial powerhouse. Even in a fast-changing world, LVMH proves that timeless luxury still has massive pricing power.

The stock has pulled back the last years due to economic concerns and weaker demand in parts of Asia. It peaked near $200 in July 2023, but now trades around $108 — a drop of nearly 46%. This is exactly the kind of dip long-term investors should embrace.

In Q1 2025, LVMH reported €20.3 billion in revenue, down 3% compared to last year. The Fashion & Leather Goods division, its most important business unit, dropped by 5%. Japan was weaker, while the U.S. performed well, especially in Fashion and Watches & Jewelry (source: LVMH 2025 Q1 Revenue Press Release). It’s clear that 2025 will be a tough year for LVMH. Analysts expect a 1% decline in revenue. But 2026 looks much better, with forecasts of 5% sales growth and 19% earnings growth (source: Yahoo Finance). As always, long-term investing is about looking ahead.

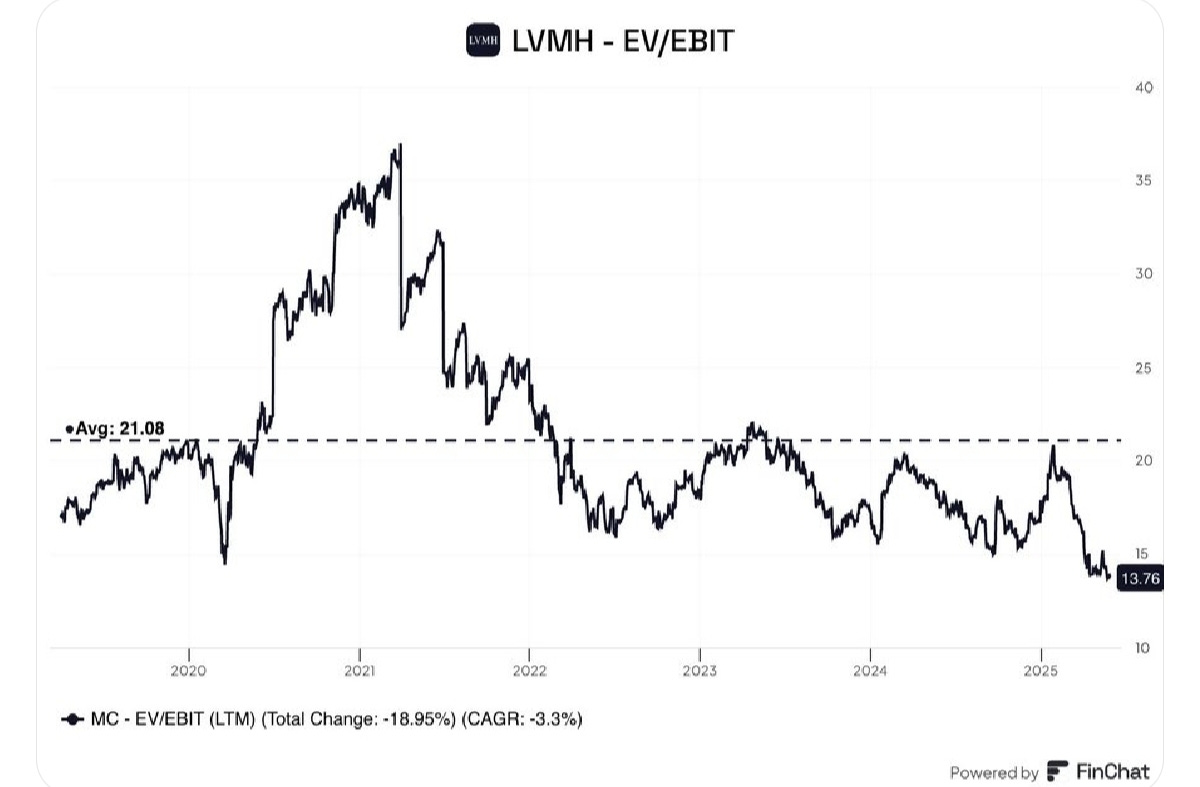

The valuation also looks attractive right now to us. The stock trades at a forward P/E of 20.8, compared to its 10-year average of 26.7, a discount of about 20% (source: GuruFocus). Looking at EV/EBITDA, LVMH is currently trading at 13.8, the lowest level in recent years (source: FinChat). On top of that, the stock offers a 2.62% dividend yield, not bad while waiting for growth to return.

For a high-quality company like LVMH, this low valuation doesn’t happen often. We believe that once growth expectations start to improve — especially in Asia — the stock could rebound quickly. Investors usually react early, so sentiment might shift before the actual results catch up.

Also worth noting: CEO Bernard Arnault has been buying more shares this year — and his purchases have become more aggressive in recent months. That’s often a clear sign of confidence from the top.

We believe LVMH is still one of the best-run businesses in the world. It owns top brands, makes strong profits, and has grown steadily for many years. It may not deliver quick wins, but it’s built to grow over the long run and we think that growth will come back. For investors who look a bit further ahead, we think this could be one of the best chances in years to buy this quality stock.

The Future Investors (Vincent & Stefan) currently hold a position in LVMH.

Fundamental score: 71 🟢 → Quality

Current stock price: $108.71

You've just seen #3 — a luxury powerhouse near its lowest valuations in years.

But honestly? The next two might be even better.

🔥 One is quietly shaping the future of AI — and still looks undervalued.

🔒 The other controls a monopoly that most investors overlook.

Ready to find out what they are?

Continue reading exclusively for our paid members ✨