Every month, we search for great companies trading at a fair price and highlight three stocks that we believe are particularly interesting based on our analysis.

We’ve shared 42 Best Buys since December 2024 and the results have been outstanding! 🔥

Our Best Buy picks delivered an average return of +20%, with some stocks exploding +153% and +107% 🚀 in just a few months!

Our selection combines fundamentals and valuation, but we always prioritize quality: it’s better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Learn more about how we score stocks on fundamentals in our Fundamental Scoring Framework article.

To keep our process disciplined and ideas fresh, we don’t feature the same Best Buy two months in a row.

Now let’s dive into our Top 3 Best Buys for February 👇

Disclaimer:

The information and opinions provided in this article are for informational and educational purposes only and should not be considered as investment advice. Please consult the general disclaimer for more details.

#3: ServiceNow (NYSE: NOW)

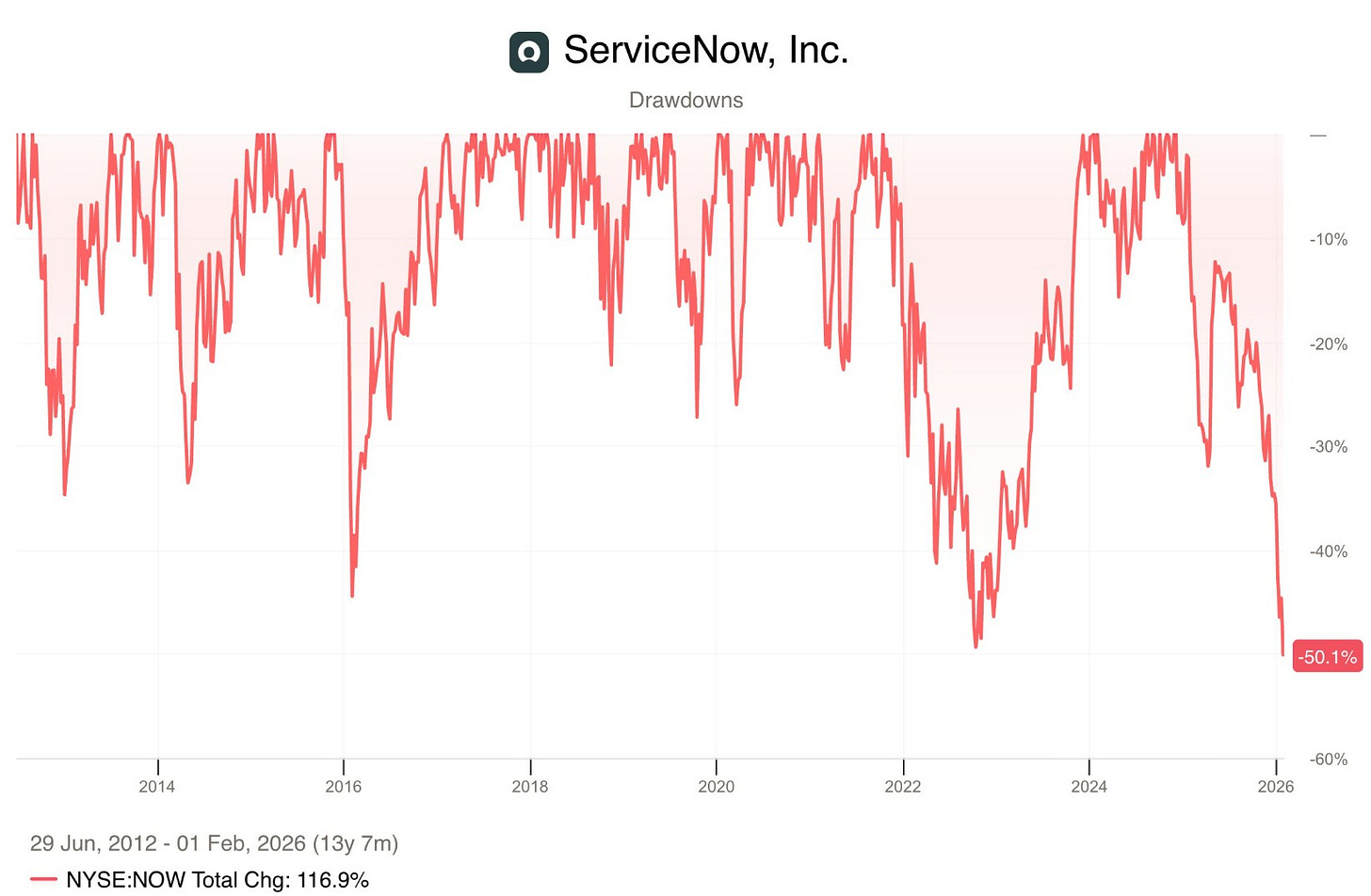

ServiceNow has pulled back to $117, about 50% below its all‑time high of $239.62 on January 28, 2025. Despite this steep decline, we continue to see it as a fundamentally strong business.

It is a leader in enterprise workflow software, with recurring revenue and deep AI integration, including agentic AI that automates complex IT, HR, and CRM tasks. We see ServiceNow as one of the software companies best positioned to benefit from AI.

For this reason, we have recently initiated a new position. The current valuation offers a great opportunity to own a high-quality software company at a much more attractive price.

What Happened?

ServiceNow’s share price has fallen as part of a broader sell-off in software stocks. Investors have been worried that new AI tools could replace traditional software, especially those that sell on a seat‑based subscription model.

A key trigger was the launch of Anthropic’s Claude Cowork on January 12, 2026, a new AI tool that automates tasks like turning screenshots into spreadsheets and drafting reports — jobs that previously required multiple tools and human work.

Because of this, many software stocks, including Intuit, Adobe, Salesforce and ServiceNow, fell sharply. The concern is that if AI tools can do more tasks at a lower cost and with fewer licences, companies might eventually buy fewer traditional software subscriptions, which would hurt long‑term revenue growth.

Even after ServiceNow reported strong Q4 2025 earnings, where both revenue and EPS beat expectations and the company raised its guidance for 2026, the stock fell further.

We believe this drop is overdone because ServiceNow is actually integrating AI deeply into its platform. This strengthens its value proposition, which we see as a long‑term advantage rather than a threat.

Why Servicenow looks attractive now

First of all, ServiceNow scores 81 🔵 (High-Quality) in our Fundamental Scoring Framework. We see this as an excellent score and one of the highest among software companies.

Source: Fiscal.ai

As you can see in the chart above, ServiceNow has experienced its largest drawdown (-50%) since its IPO, comparable to the decline seen in 2022.

ServiceNow looks attractive at today’s price. The stock’s current P/E (LTM) is 70, which seems high, but the forward P/E (NTM) is 28.2 (source: Koyfin), making it much more reasonable. The PEG ratio, which compares P/E to expected earnings growth, is also healthy at 1.18 (source: Koyfin). The Price-to-Free-Cash-Flow (LTM) is 26.7, the lowest level ever, showing the stock is much more attractively valued than before.

We believe valuations for ServiceNow have never looked this appealing. The current price gives us a chance to own a high-quality company expected to grow EPS and revenue by around 20% per year over the next three years.

On top of that, ServiceNow has announced a $5 billion share buyback. This reduces the number of outstanding shares and increases value per share for shareholders, making the stock even attractive.

The Future Investors (Vincent & Stefan) currently hold a position in ServiceNow.

Fundamental score: 81 🔵 → High-Quality

Current stock price: $118.00

The next two? Two quality companies trading at very attractive valuations right now.

🚀 One is a tech titan powering the digital world — everyone knows it, but few realize how attractively it’s trading right now.

💎 The other is a world-class business with a 95 🟣 (exceptional) fundamental score — the highest we’ve ever awarded! It’s growing rapidly and now trading at a very attractive valuation.

Ready to discover our #1 and #2 Best Buys?

They’re just one click away 🔓 — exclusively for our paid members ✨

SPECIAL DEAL:

🎁 Upgrade now and get 30% off (only 20 spots left ⏳)

Get instant access to all our Best Buys, our Top 10 Stocks for 2026, our Portfolios, all Deep Dives — plus 375+ premium articles to explore!

✅ Already trusted by 4,200+ investors