Every month, we search for great companies trading at a fair price and highlight three stocks that we believe are particularly interesting based on our analysis.

We’ve shared 23 Best Buys since December 2024 and the results have been outstanding! 🔥

Our Best Buy picks delivered an average return of +21.7%, with one stock exploding +130% 🚀 in just six months!

In our selection process, we combine fundamentals with valuation. But we believe it’s better to buy a wonderful company at a fair price than a fair company at a wonderful price — so fundamentals always come first.

Now let’s dive into our Top 3 Best Buys for January 👇

Disclaimer:

The information and opinions provided in this article are for informational and educational purposes only and should not be considered as investment advice. Please consult the general disclaimer for more details.

#3: Uber (NYSE: UBER)

We have included Uber in our Best Buys for January. Exactly one year ago, in January 2025, we also highlighted Uber when it was trading around $60 per share. Since then, the stock climbed above $100, but is now trading around $82. At this price, we find Uber at least as attractive as a year ago. And fundamentally, the business has only become stronger.

What Happened?

This drop in Uber’s stock price wasn’t the result of weak performance. Q3 results were strong: Uber beat expectations on both revenue and earnings, and even raised its outlook for Q4 gross bookings. The business is still performing very well.

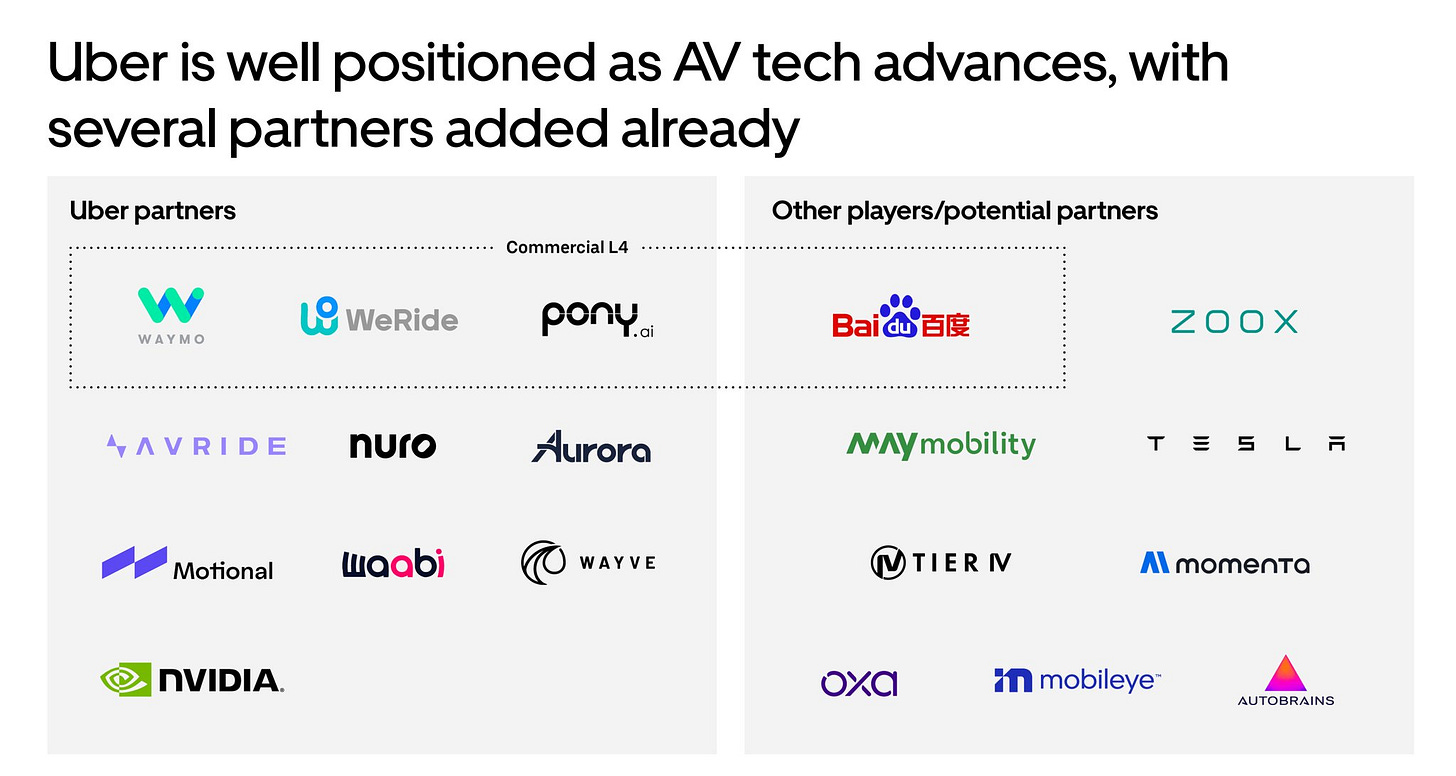

At the same time, Uber is making real progress in autonomous driving. The company is working with partners like Waymo, WeRide, Pony AI, and plans a robotaxi trial with Baidu’s Apollo Go in London this year. Still, many investors worry that Tesla or Waymo could one day replace Uber with their own robotaxi networks.

Source: Uber Investor Relations, Autonomous Vehicles Spotlight

We don’t think that will happen. Uber already has the users, the demand, the data, the city relationships, and the platform that people trust. It doesn’t need to build the best self-driving technology itself — it can work with the companies that do. Robotaxis are already available through Uber in cities like Phoenix, Austin, and Abu Dhabi, showing that this future is already starting to happen on Uber’s platform.

On top of that, Uber still has strong businesses in delivery and freight, which continue to support the company’s long-term growth.

Why Uber looks attractive now

After the recent pullback, Uber looks attractive again at today’s price levels. The stock trades at a P/E of 10.6 and a forward P/E of 23.2, which looks very reasonable for a company of Uber’s scale and quality. EPS will be lower this year because of one-off effects in 2025, not because the business is weakening.

Looking ahead, analysts expect around 16% revenue CAGR over the next three years, showing that Uber is still in growth mode. At the same time, Uber has become a strong cash generator, and with a Price-to-FCF of about 19.9, the valuation is attractive relative to its outlook.

Uber is successfully growing its core business today while also building a strong strategic position for the autonomous future. With strong fundamentals and the share price below recent highs, this looks like a good moment to add Uber to your portfolio or expand your existing position.

The Future Investors (Vincent & Stefan) currently hold a position in Uber.

Fundamental score: 70 🟢 → Quality

Current stock price: $82.86

The next two? Quality companies trading at very attractive valuations right now.

🚀 One is a beaten-down tech leader with massive breakout potential.

💎 The other is a world-class business — trading at its lowest forward P/E in a decade.

Ready to discover our #1 and #2 Best Buys?

They’re just one click away 🔓 — exclusively for our premium members ✨

🔥 Upgrade now to paid and get 25% off!

Get instant access to all our Best Buys, our Top 10 Stocks for 2026, our Portfolios, all Deep Dives — plus 375+ premium articles to explore! Cancel anytime ✅