Every month, we search for great companies trading at a fair price and highlight three stocks that we believe are particularly interesting based on our analysis.

We’ve shared 20 Best Buys since December 2024 and the results have been outstanding! 🔥

Our Best Buy selections have delivered an average return of +28.4%, with one stock exploding +163% 🚀 in just a few months!

In our selection process, we look at both fundamentals and valuation. But we believe it’s better to buy a wonderful company at a fair price than a fair company at a wonderful price. That’s why we focus on the fundamentals first and the valuation second.

Now let’s dive into our Top 3 Best Buys for November 👇

Spoiler: #2 is the clear leader in a duopoly — finally trading at an attractive valuation! 💎🤫

Disclaimer:

The information and opinions provided in this article are for informational and educational purposes only and should not be considered as investment advice. Please consult the general disclaimer for more details.

#3: Synopsys (NASDAQ: SNPS)

Synopsys returns to our Best Buy list for November. We first recommended it in March, and the stock is back around the same level — yet 30% below the all-time highs it reached this summer. A great opportunity to own a quality company at a much better price.

What Happened?

At the end of July, Synopsys reached new all-time highs, helped by the ongoing AI boom in the chip industry. Its software plays a key role in designing the advanced chips used by Nvidia, AMD, and Intel, placing Synopsys right at the heart of the AI revolution.

But on September 9, the company reported its Q3 FY25 results, and investors weren’t happy.

Revenue came in at $1.74B (+14% YoY) and EPS at $3.39, both below expectations.

Synopsys also lowered its outlook for Q4 and full-year 2025, expecting slower growth for the rest of the year.

The weaker results came down to a few things:

Lower demand in the IP division, as chipmakers delayed new projects.

Export restrictions to China, which continue to limit sales.

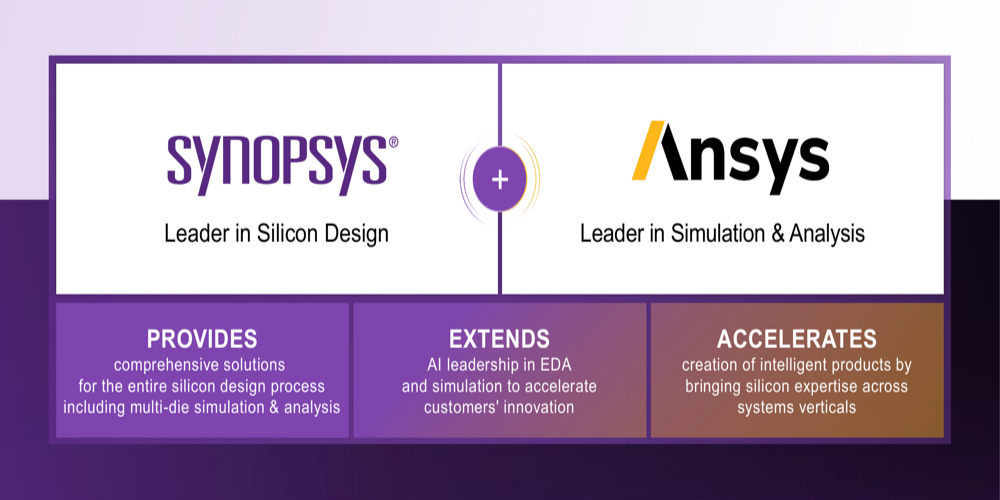

Higher costs from the Ansys integration, putting short-term pressure on margins.

A short pause in chip design spending after two very strong years.

The stock fell more than 35% in a single day — a rare move for a company of this quality. Despite the drop, Synopsys remains the clear leader in chip design software, powering the chips behind AI, data centers, and next-generation computing.

With Ansys soon fully integrated, its position will only become stronger.

Why Synopsys looks attractive now?

We see the recent weak results as temporary. Lower demand in the IP division, export restrictions to China, and higher integration costs from Ansys all weighed on performance, but none of these change the bigger picture — the long-term thesis is still intact.

Synopsys remains at the core of the AI chip race. Together with Cadence, it forms a duopoly in chip design software — the technology that the world’s leading chipmakers depend on. As demand for AI chips and data-center computing keeps rising, Synopsys’s design tools will only become more important.

The Ansys integration adds extra strength, combining chip design and simulation in one platform. As integration costs fade, this merger will help expand margins, reach more customers, and open new market opportunities.

Source: Synopsys Q325 Investor Overview

From a valuation standpoint, Synopsys now looks very attractive. It trades at a P/E of 35.8, well below its 10-year average of 50. The forward P/E is expected to fall to 34.6 by the end of 2025 and 31.7 in 2026 (source: Stock Analysis), offering investors a chance to buy quality at a discount.

While 2025 may still be a transition year, investing is about looking ahead. Analysts expect revenue to grow 37% next year, showing how quickly Synopsys can bounce back as growth returns.

At current levels, the stock trades well below fair value, giving investors the chance to own a quality company, operating in a duopoly and positioned for years of growth ahead.

The Future Investors (Vincent & Stefan) currently hold a position in Synopsys.

Fundamental score: 77 🟢 → Quality

Current stock price: $453.82

The next two? Both are quality businesses the world can’t live without — now attractively priced.

💰 One dominates an essential industry, generating cash for decades.

🌐 The other connects the world — now reinventing itself for the AI era.

Ready to discover our #1 and #2 Best Buys?

They’re just one click away 🔓 — exclusively for our premium members ✨

🔥 Upgrade now to paid and get 30% off!

Get instant access to this article, all other Best Buys, our Portfolios, all Deep Dives — plus 350+ premium articles to explore! Cancel anytime ✅