📰 Big Setback for Google: Loses Power in Online Advertising

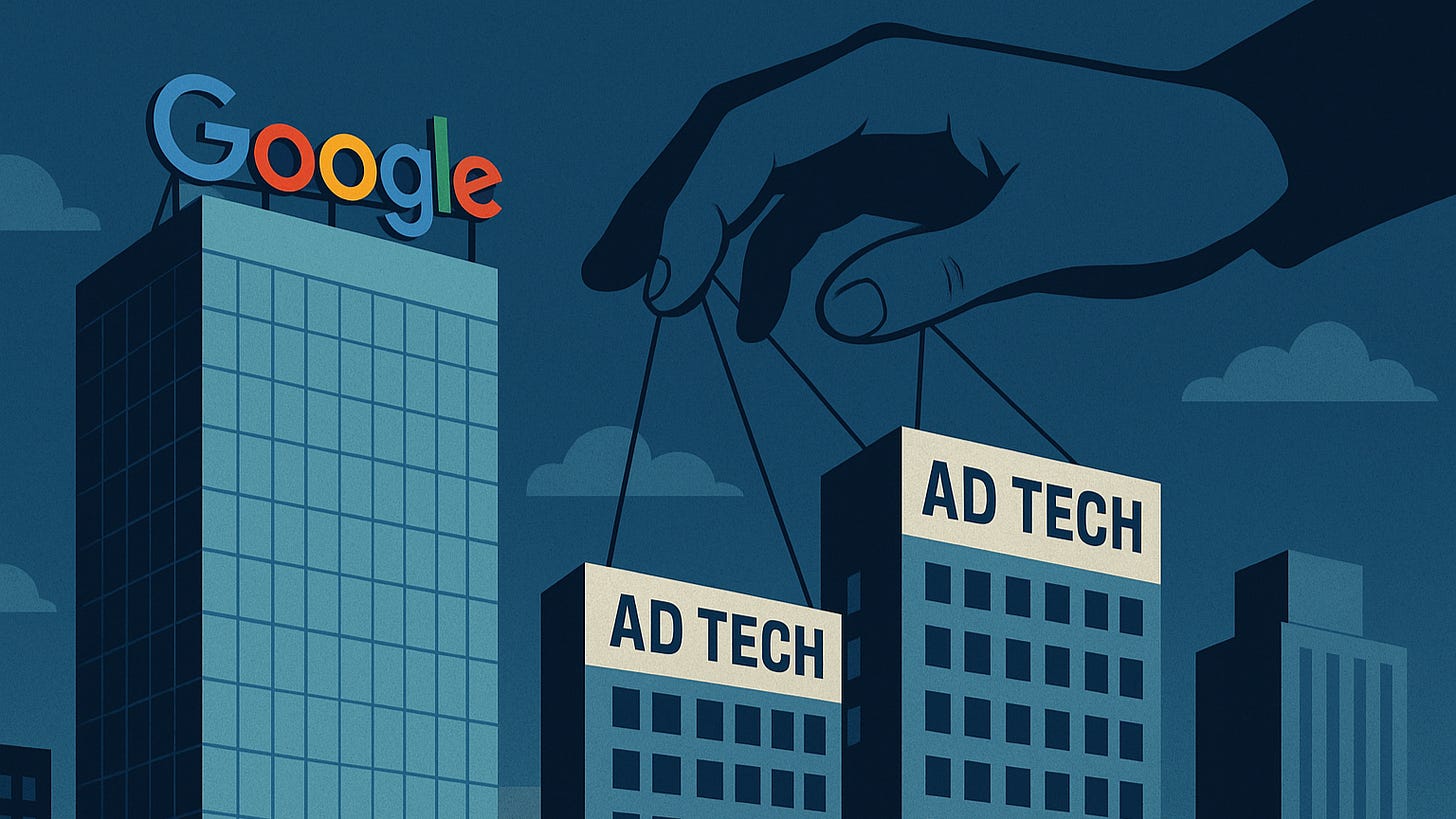

A U.S. judge says Google kept its top position in ad tech by using unfair methods. What does this mean for Google — and for its competitors?

A U.S. federal judge has ruled that the company acted unfairly to keep control over the online advertising technology market. This decision could bring major changes not just for Google GOOGL 0.00%↑, but for the entire online ad industry.

The case focused on Google’s power in three important areas: publisher ad servers, ad networks for advertisers, and ad exchanges where ads are bought and sold. The court found that Google tied its services together in a way that made it very hard for other companies to compete. In the end, publishers and advertisers had few real choices and ended up paying more.

Google said that its tools made things easier for publishers and advertisers and helped them earn more money. But the judge disagreed. Together with an earlier ruling about Google’s monopoly in online search, this decision puts Google at real risk of having to break up parts of its business.

What does this mean for Google?

If the court forces Google to sell parts of its ad tech business, like its ad exchange or its tools for publishers, it could hurt one of Google’s biggest sources of income.

It would also break apart the system that kept publishers and advertisers locked inside Google’s network. This could change a large part of how the internet economy works today.

Who could benefit the most?

Several independent companies are ready to grow if Google’s power weakens. They already compete with Google in ad tech, especially in helping publishers sell ads:

Magnite: the largest independent supply-side platform (SSP)

PubMatic: a well-known SSP, valued for its openness

Xandr: now owned by Microsoft

OpenX and Index Exchange: strong competitors as well

If publishers are able to choose from more platforms, these companies could expand quickly. Prices could become fairer, and there could be more new ideas about how ads are bought and sold.

Some large media companies, like The New York Times, are also building their own ad tech tools, making them less dependent on Google.

What about The Trade Desk?

The Trade Desk mostly works with advertisers (the buy-side of the market), but it could still benefit from these changes. If Google’s control over where ads appear becomes weaker, advertisers will have more choices and better deals. This fits well with The Trade Desk’s goal to offer a more open, fair, and transparent way to buy ads across the web.

Competitors like Magnite, PubMatic, and Xandr are ready to grow. And companies like The Trade Desk could also do well in a market that becomes more open and competitive.

Source: The New York Times, The Verge

Disclaimer:

The information and opinions provided in this article are for informational and educational purposes only and should not be considered as investment advice or a recommendation to buy, sell, or hold any financial product, security, or asset. The Future Investors does not provide personalized investment advice and is not a licensed financial advisor. Always do your own research before making any investment decisions and consult with a qualified financial professional before making any investment decisions. Please consult the general disclaimer for more details.