📈 How Did Our Portfolio Perform in 2024? A Recap

An overview of our top performers, key challenges and insights.

2025 is already a few days old, but let's take a moment to reflect on 2024 and how our portfolios performed last year. Did we manage to beat the market? Which stocks stood out, and where did we face challenges? Here’s a recap of our portfolios, highlighting key takeaways, wins, and areas for improvement as we move into the new year.

Overall performance

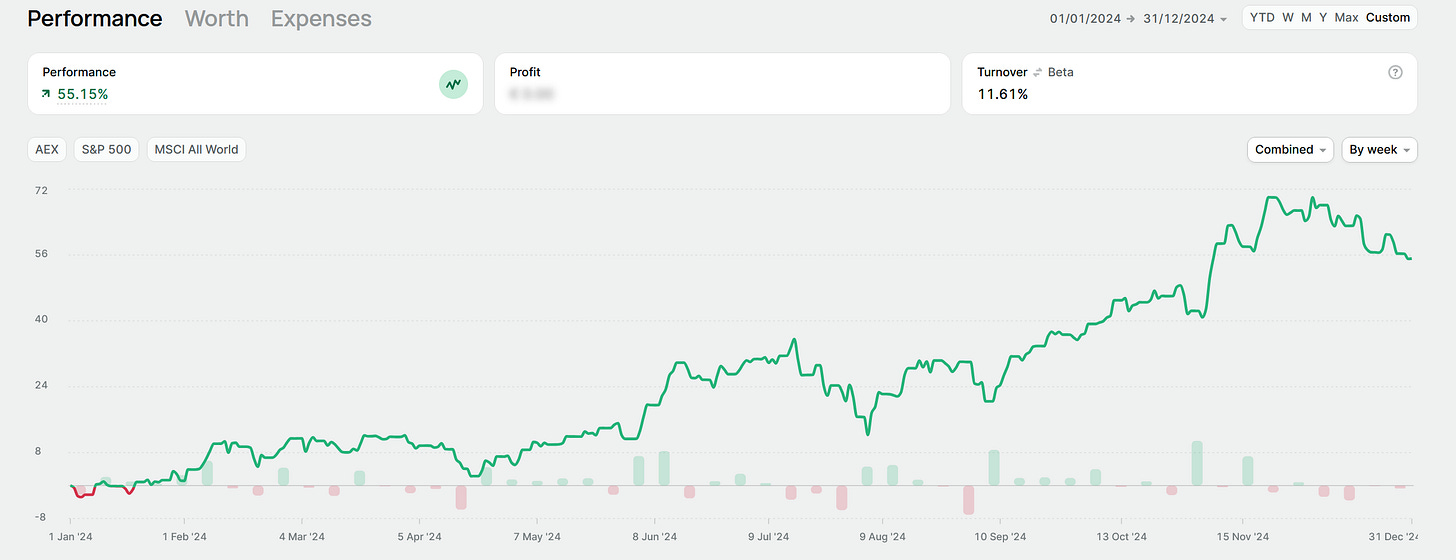

To get straight to the point, 2024 was an outstanding year for both of our portfolios. Vincent’s portfolio delivered an impressive return of 55.15%, while Stefan’s portfolio also performed strongly with a return of 32.59%.

The year started off slow in January, but momentum really picked up in February as market conditions improved. June and November were particularly strong, proving to be our best months. However, we did face a significant drop in early August, largely driven by market concerns over the carry trade in Japan, which also had an impact on our portfolios. Both portfolios peaked at the end of November, with Vincent’s portfolio surpassing a 70% return.

Unfortunately, December saw a modest dip, but we ultimately closed the year with strong overall results: 55.15% for Vincent and 32.59% for Stefan.

Portfolio Vincent - Returns 2024, Portfolio Dividend Tracker

Portfolio Stefan - Returns 2024, Portfolio Dividend Tracker

The Future Investors vs. the market

So, how did we perform this year compared to the broader market? Did we outperform the indexes? Let's take a look at the results of three key indexes: the S&P 500, the Nasdaq, and the Dow. Here are their returns of 2024:

S&P 500: 23.31%

Nasdaq: 28.64%

Dow: 12.88%

With returns of 55.15% for Vincent and 32.59% for Stefan this year, both portfolios have significantly outperformed all three major indexes! Of course, one year is not a definitive measure—our goal is to consistently outperform the indexes over the long term.

For now, let’s take a look at the stocks in each portfolio that contributed the most to these outstanding results.