Welcome to Investor Talk — where we interview successful investors to uncover their journeys, strategies, and the lessons they've learned. Get inspired by real stories and gain valuable insights to sharpen your own investment approach.

Every interview follows the same set of sharp, insightful questions — such as “What is your investment strategy?”, “What are your highest conviction stocks?”, and “What’s the biggest investment mistake you’ve made?”

In this edition, we have the pleasure of interviewing:

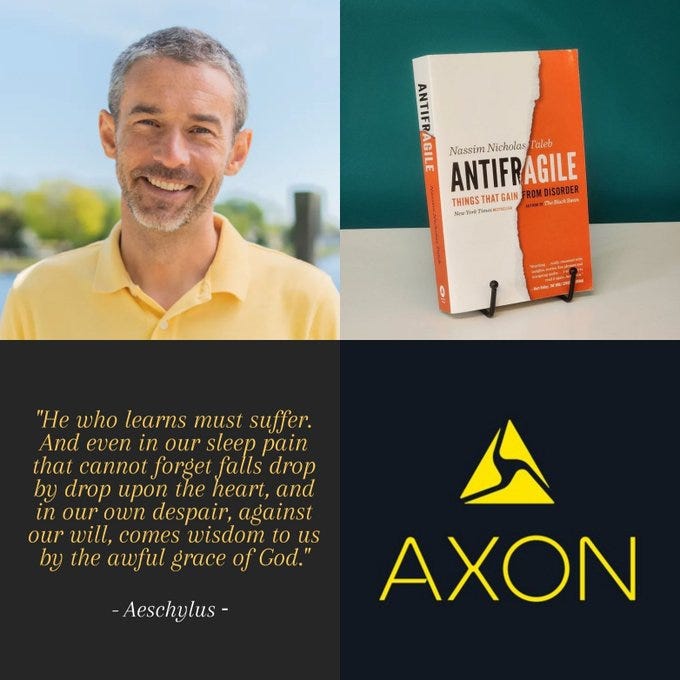

Name: Brian Stoffel @Brian_Stoffel_

Age: 42

Residence/Country: United States

Invests since: 2009

𝗜𝗻𝘁𝗿𝗼𝗱𝘂𝗰𝘁𝗶𝗼𝗻

I would never have guessed I'd end up where I am now. I eschewed anything having to do with finance as a youth, as I considered it the root of all evil. Coming out of college, I was squarely focused on becoming a public school teacher. That's exactly what I did - first in rural Iowa, then in inner-city Washington, DC. That life, however, was exhausting. My wife (also a teacher) and I took a year off and moved to Costa Rica. While there, I got very antsy. When I had to rollover our retirement funds, I started researching investment. That led me to The Motley Fool. After posting actively on their boards for a year, I became a contract writer. The rest, as they say, is history...

𝗪𝗵𝗮𝘁 𝗶𝘀 𝘆𝗼𝘂𝗿 𝗶𝗻𝘃𝗲𝘀𝘁𝗺𝗲𝗻𝘁 𝘀𝘁𝗿𝗮𝘁𝗲𝗴𝘆?

I am squarely focused on antifragility. That means, I want to own companies and stocks that tend to benefit from the vagaries of time, chaos, and the unexpected. That means focusing on wide moat businesses, with a demonstrated history of optionality, lots of cash on hand, and management with skin in the game. Recently, it has also tended to focus on how a company's valuation can make the stock (though not necessarily the business) more fragile/antifragile.

𝗛𝗼𝘄 𝗺𝗮𝗻𝘆 𝘀𝘁𝗼𝗰𝗸𝘀 𝗮𝗿𝗲 𝗰𝘂𝗿𝗿𝗲𝗻𝘁𝗹𝘆 𝗵𝗲𝗹𝗱 𝗶𝗻 𝘆𝗼𝘂𝗿 𝗽𝗼𝗿𝘁𝗳𝗼𝗹𝗶𝗼?

My portfolio currently consists of 16 positions.

𝗪𝗵𝗶𝗰𝗵 𝘀𝗲𝗰𝘁𝗼𝗿𝘀 𝗱𝗼 𝘆𝗼𝘂 𝗺𝗮𝗶𝗻𝗹𝘆 𝗳𝗼𝗰𝘂𝘀 𝗼𝗻?

This isn't on purpose, but E-Commerce and SaaS are two areas of heavy investments.

𝗪𝗵𝗮𝘁 𝗮𝗿𝗲 𝘆𝗼𝘂𝗿 𝗵𝗶𝗴𝗵𝗲𝘀𝘁 𝗰𝗼𝗻𝘃𝗶𝗰𝘁𝗶𝗼𝗻 𝘀𝘁𝗼𝗰𝗸𝘀?

$AXON - Axon

$MELI - MercadoLibre

$AMZN - Amazon

𝗪𝗵𝗶𝗰𝗵 𝘀𝘁𝗼𝗰𝗸 𝗵𝗮𝘀 𝘁𝗵𝗲 𝗵𝗶𝗴𝗵𝗲𝘀𝘁 𝗿𝗲𝘁𝘂𝗿𝗻?

$AMZN - Amazon has been the best performer in my portfolio, with a return of >2,000%.

𝗪𝗵𝗮𝘁 𝗶𝘀 𝘁𝗵𝗲 𝗯𝗶𝗴𝗴𝗲𝘀𝘁 𝗶𝗻𝘃𝗲𝘀𝘁𝗺𝗲𝗻𝘁 𝗺𝗶𝘀𝘁𝗮𝗸𝗲 𝘆𝗼𝘂 𝗵𝗮𝘃𝗲 𝗺𝗮𝗱𝗲?

My biggest investing mistake is not trimming Shopify $SHOP in 2021 when it was ~20% of my portfolio and had ridiculous expectations baked into the stock. My re-focusing on valuation came from this insight.

𝗠𝘆 𝗳𝗮𝘃𝗼𝗿𝗶𝘁𝗲𝘀

Favorite book: Antifragile by Nassim Nicholas Taleb @nntaleb

Favorite podcasts: We Can Do Hard Things by Glennon and Amanda Doyle, Amy Wambach @GlennonDoyle

Favorite quote: "He who learns must suffer. And even in our sleep pain that cannot forget falls drop by drop upon the heart, and in our own despair, against our will, comes wisdom to us by the awful grace of God." - Aeschylus

Favorite FinX account: @nntaleb gives me great insights!

𝗪𝗵𝗲𝗿𝗲 𝗰𝗮𝗻 𝘄𝗲 𝗳𝗶𝗻𝗱 𝗺𝗼𝗿𝗲 𝗶𝗻𝗳𝗼 𝗮𝗯𝗼𝘂𝘁 𝘆𝗼𝘂?

On our website http://longtermmindset.co we create educational content that can help anyone to learn how the stock market works and to help you to become a better investor.

Disclaimer:

The information and opinions provided in this article are for informational and educational purposes only and should not be considered as investment advice or a recommendation to buy, sell, or hold any financial product, security, or asset. The Future Investors does not provide personalized investment advice and is not a licensed financial advisor. Always do your own research before making any investment decisions and consult with a qualified financial professional before making any investment decisions. Please consult the general disclaimer for more details.