As 2024 comes almost to an end, Nubank has marked another year of impressive growth and strategic advancements. Here are the 8 milestones that defined Nubank’s success in 2024 🏦💜.

𝟭. 𝗖𝘂𝘀𝘁𝗼𝗺𝗲𝗿 𝗚𝗿𝗼𝘄𝘁𝗵

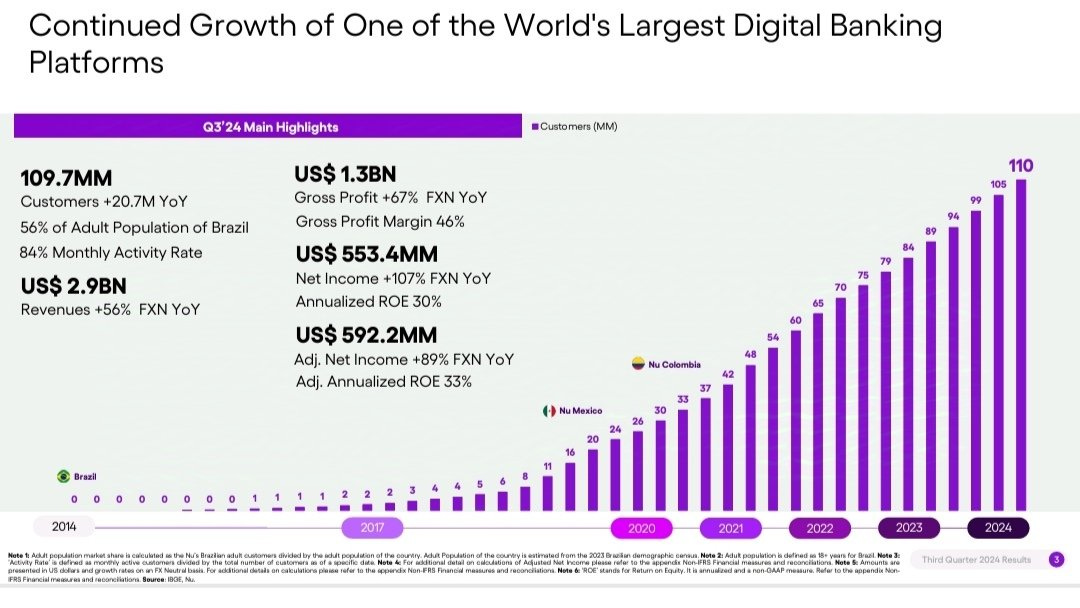

The company reached 110 million customers, with 100 million in Brazil, representing 57% of the adult population. It also expanded internationally, reaching 9 million customers in Mexico and 2 million in Colombia.

Source: Nu Holdings Investor Relations

𝟮. 𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗥𝗲𝘀𝘂𝗹𝘁𝘀

Nubank posted US$2.94 billion in revenue and US$553 million in net income for Q3 2024 and the ROE surpassed 30% despite significant excess capital. It showcased the strength of its business model.

Source: Nu Holdings Investor Relations

𝟯. 𝗨𝗹𝘁𝗿𝗮𝘃𝗶𝗼𝗹𝗲𝘁𝗮 𝗣𝗿𝗼𝗱𝘂𝗰𝘁 𝗘𝘃𝗼𝗹𝘂𝘁𝗶𝗼𝗻

Ultravioleta expanded services for high-income customers, introducing a Global Account (via Wise) with multi-currency support and a debit card, plus a free eSIM (via Gigs) offering 10GB internet for global travel.

Source: Nubank Website

𝟰. 𝗘𝘅𝗽𝗮𝗻𝘀𝗶𝗼𝗻 𝗼𝗳 𝗦𝗲𝗿𝘃𝗶𝗰𝗲𝘀

Nubank launched NuViagens for travel bookings with perks like cashback and 24/7 support and introduced exclusive high-yield CDBs for high-income customers, offering competitive returns and FGC protection.

𝟱. 𝗧𝗲𝗰𝗵𝗻𝗼𝗹𝗼𝗴𝗶𝗰𝗮𝗹 𝗜𝗻𝗻𝗼𝘃𝗮𝘁𝗶𝗼𝗻

The acquisition of Hyperplane strengthened Nubank's AI capabilities, improving credit underwriting and personalizing services through machine learning and data analysis, for better risk assessment and tailored fin solutions.

𝟲. 𝗡𝗲𝘄 𝗕𝘂𝘀𝗶𝗻𝗲𝘀𝘀 𝗟𝗶𝗻𝗲𝘀

NuCel: A mobile phone service offering flexible, contract-free plans integrated with financial benefits.

Working Capital Loans: Launched to support small and medium-sized enterprises.

Source: Connecting the dots in FinTech

𝟳. 𝗜𝗻𝘁𝗲𝗿𝗻𝗮𝘁𝗶𝗼𝗻𝗮𝗹 𝗚𝗿𝗼𝘄𝘁𝗵 - 𝗠𝗲𝘅𝗶𝗰𝗼

Nubank invested over US$1.4 billion in expanding its services, adding features like mobile recharges, credit limit increases, and virtual cards. Nu Mexico is working on obtaining a banking license.

𝟴. 𝗜𝗻𝘁𝗲𝗿𝗻𝗮𝘁𝗶𝗼𝗻𝗮𝗹 𝗚𝗿𝗼𝘄𝘁𝗵 - 𝗖𝗼𝗹𝗼𝗺𝗯𝗶𝗮

Nubank launched Cuenta Nu, a fee-free digital account, and secured a US$150 million loan. The company unified its operations, strengthening its commitment to serving Colombia’s 2 million customers.

Source: Nubank Blog

Source: NuBank Investor Relations

The Future Investors (Vincent & Stefan) currently hold a position in Nu Holdings.

Disclaimer:

The information and opinions provided in this article are for informational and educational purposes only and should not be considered as investment advice or a recommendation to buy, sell, or hold any financial product, security, or asset. The Future Investors does not provide personalized investment advice and is not a licensed financial advisor. Always do your own research before making any investment decisions and consult with a qualified financial professional before making any investment decisions. Please consult the general disclaimer for more details.