As we move into 2026, the market feels different. The easy gains are gone. AI is no longer hype — it’s showing up in results — but investors are more selective. Big Tech still matters, but not every stock is rising. With stretched valuations, geopolitical uncertainty, and an economy in transition, nobody knows exactly how 2026 will play out. It could be a challenging year — making selectivity more important than ever.

Markets like this reward quality. Instead of chasing hype, this is the time to own strong businesses with pricing power, solid fundamentals, and real long-term stories — companies that can perform even when the headlines turn negative.

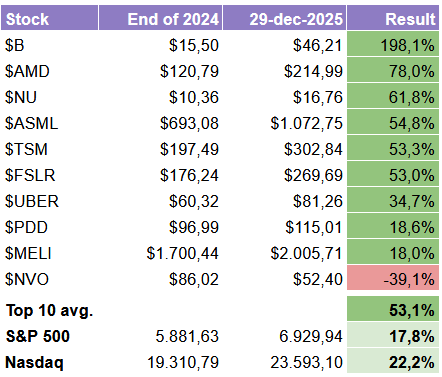

Before we look ahead, a quick look back at our Top 10 Picks for 2025.

And the results were outstanding:

An average return of 53.1%, that’s 3× the return of the S&P 500 🔥

9 of our 10 stocks finished positive — all 9 beat the S&P 500 and 7 outperformed the Nasdaq 📈

Top performer: Barrick Gold, delivering an incredible +198% 🚀

This track record gives us confidence in our 2026 picks. That’s why we’ve selected 10 companies we believe can beat the S&P 500 in 2026 — not based on hype, but on real business strength. Let’s dive into them one by one 👇

Disclaimer:

The information and opinions provided in this article are for informational and educational purposes only and should not be considered as investment advice or a recommendation to buy, sell, or hold any financial product, security, or asset. The Future Investors does not provide personalized investment advice and is not a licensed financial advisor. Always do your own research before making any investment decisions and consult with a qualified financial professional before making any investment decisions. Please consult the general disclaimer for more details.

#10: Meta Platforms (NASDAQ: META)

Meta heads into 2026 as one of the most attractive opportunities within Big Tech. Analysts expect 17.9% revenue growth next year and 20.3% EPS growth, which is exceptionally strong for a company of this size. And the best part? The valuation is still attractive: a P/E of 29.3, forward P/E of 21.6, and a PEG ratio of 1.35. That makes Meta the cheapest company in the Magnificent 7, which is rare for a business delivering this level of growth and profitability.

After its Q3 results, the stock dropped around 12%. Not because the business weakened, but due to a large one-time tax charge and concerns about rising investments. In reality, Meta was still doing great, with record revenue, growing engagement, and strong cash flows. Without that one-off charge, it proved that the core business is still in great shape.

These higher costs aren’t wasted money — they’re intentional investments in the future. Meta is building large AI infrastructure, new data centers, stronger AI models, and new products like AI glasses. AI is already helping people spend more time on Meta’s apps, improving recommendations, and strengthening ad performance across Facebook, Instagram, Threads, and Reels. That means it’s helping results today, while also building the foundation for the years ahead.

With strong growth expectations, solid fundamentals, a clear AI strategy, and an attractive valuation, we see Meta as a standout pick for 2026.

The Future Investors (Vincent & Stefan) currently do not hold a position in Meta.

Fundamental score: 78 🟢 → Quality

Current stock price: $663.29

#9: Dino Polska (OTC: DNOPY)

Dino Polska may not be a flashy tech company, but it is one of the most impressive retail growth stories in Europe. The company keeps expanding across Poland, adding 320–330 new stores this year, bringing the total close to 3,000 locations. And Dino plans to open even more stores in 2026 than in 2025, showing strong confidence in its model. The company is also still founder-led: Chairman and majority shareholder Tomasz Biernacki remains closely involved — something many long-term investors value.

To support this growth, Dino is expanding its logistics network and expects to add around two new distribution centers per year, so the store base can continue to grow efficiently.

Valuation is another reason Dino stands out. The stock trades at a P/E of 24.9 versus a 10-year average of 35.3, while its forward P/E of 18.8 is the lowest of the past decade. Meanwhile, analysts expect 17.5% revenue growth next year and 26.9% EPS growth — numbers you normally see at high-growth tech companies, not a supermarket chain.

Investors also gain exposure to Poland, one of the fastest-growing economies in Europe, with GDP expected to grow roughly 3.2–3.5% in 2025 and about 3.5% in 2026. The stock is still about 27% below its all-time high, which is unusual for Dino, as the share price is normally quite stable. That could make 2026 a very interesting opportunity for investors.

Dino Polska offers strong growth, disciplined expansion, attractive pricing, founder-led leadership, and exposure to a growing European economy — and for these reasons, it proudly joins our Top Picks for 2026.

The Future Investors (Vincent & Stefan) currently do not hold a position in Dino Polska.

Fundamental score: 68 🟡 → Reasonable

Current stock price: $11.64

#8: Nu Holdings (NYSE: NU)

Nu Holdings is one of the most exciting growth stories in global fintech today. With more than 127 million customers across Brazil, Mexico, and Colombia, the company has built the largest digital banking platform in the world — and it’s still expanding fast. Nubank keeps adding new services like lending, payments, insurance, and investments, rapidly becoming a true financial “super-app” and increasing the value it generates per customer.

This isn’t just growth without discipline. Nu is profitable, with improving margins, strong cost efficiency, better credit quality, and effective risk management. While many fintechs struggle to turn scale into profit, Nubank is proving it can do both.

And the growth story isn’t limited to Latin America. Mexico is accelerating, Colombia is expanding, and Nubank is positioning itself globally. The company has applied for a U.S. national bank charter, is exploring a potential legal domicile move to the UK, and is investing in emerging-market opportunities such as South Africa and the Philippines. There is still plenty of growth ahead.

The valuation makes it even more attractive. For 2026, analysts expect 31.8% revenue growth and 43.8% EPS growth — estimates only a few companies in the world can match. Nubank trades at a forward P/E of 19.5 and a PEG ratio of just 0.4, the lowest of all our Top Picks. In our Fundamental Framework, Nu scores 83, putting it in our High-Quality category.

Nu Holdings has what most companies never achieve: massive scale, strong profitability, rapid growth, a huge addressable market, and expansion plans that can significantly widen its reach. It is executing, gaining market share, and building one of the most powerful consumer finance platforms in the world. That’s why — just like last year — we are once again including Nu Holdings in our Top 10 Picks for 2026.

The Future Investors (Vincent & Stefan) currently hold a position in Nu Holdings.

Fundamental score: 83 🔵 → High-Quality

Current stock price: $16.76

You’ve seen our first three Top Picks for 2026. They already show the quality we’re focusing on.

Our next 7 Top Picks for 2026 include:

🤖 A high-quality software leader with accelerating AI momentum

🚀 A rapidly rising infrastructure powerhouse with multibagger potential

🎯 A world-class industry leader with a massive TAM, priced like a value stock

Ready to unlock the other 7 Top Picks for 2026?

They’re just one click away 🔓 — exclusively for our premium members ✨

🔥 Year-End Deal: 40% Off! 🚀✨

Start 2026 strong! Get instant access to all Top 10 Picks for 2026, our Portfolios, our Best Buys, all Deep Dives — plus 350+ premium articles to explore! Cancel anytime ✅