🎓 Are You Using the Piotroski F-Score to Spot Strong Stocks?

How this 9-point scoring system helps identify financially strong companies and avoid weak investments

When looking for good investments, it's important to know if a company is financially healthy. In 2000, accounting professor Joseph Piotroski created the Piotroski F-Score, a system that helps investors separate strong companies from weak ones.

This score looks at nine financial factors and gives each company a score between 0 and 9. A higher score means a company is in better shape, while a lower score could be a warning sign.

How the Piotroski F-Score works

The F-Score is based on nine simple financial checks, grouped into three categories: profitability, debt and liquidity, and efficiency.

1️⃣ Profitability (3 points)

✔️ Positive Return on Assets (1 point) – The company is making a profit.

✔️ Positive Operating Cash Flow (1 point) – The business is generating real cash from its operations.

✔️ Higher ROA than last year (1 point) – The company’s profits are improving.

These checks show if a company is making money and improving its financial results.

2️⃣ Debt & Liquidity (3 points)

✔️ Operating Cash Flow is higher than net income (1 point) – The company’s cash flow is strong and not just based on accounting numbers.

✔️ Less long-term debt than last year (1 point) – The company is reducing its debt.

✔️ A higher current ratio than last year (1 point) – The company is in a better position to pay short-term bills.

These points help measure if a company is managing its debt well and staying financially stable.

3️⃣ Efficiency & Stability (3 points)

✔️ No new shares issued (1 point) – The company is not diluting existing shareholders.

✔️ Higher gross margin than last year (1 point) – The company is making more money on its sales.

✔️ Higher asset turnover than last year (1 point) – The company is using its assets more efficiently.

A company that scores well here is managing its costs and assets wisely, which is a good sign for long-term success.

What the score means

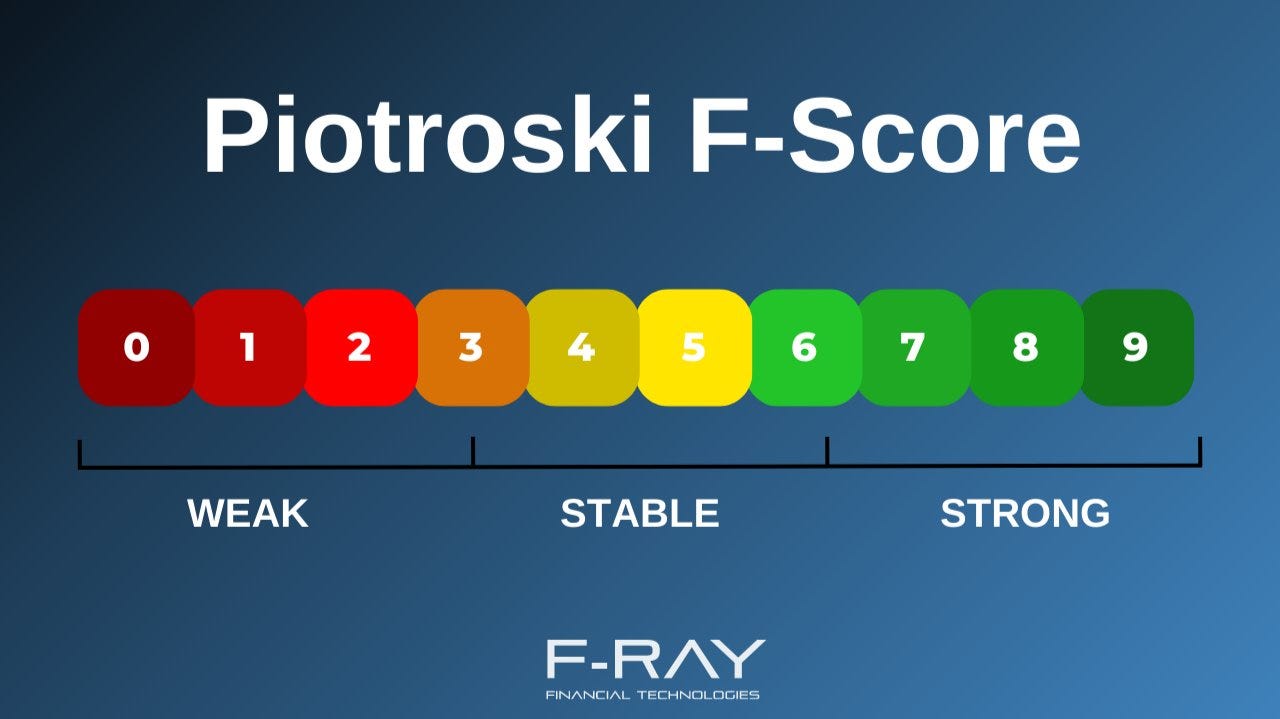

After checking all nine factors, companies get a total score between 0 and 9:

🚨 0 - 3 (Weak): The company may be struggling financially and could be risky.

⚖️ 4 - 6 (Stable): The company has both strong and weak points but is in decent shape.

✅ 7 - 9 (Strong): The company is financially solid and well-managed.

Source: F-Ray Financial Technologies

Examples of companies and their scores

Here are real-world examples of companies with weak, stable, and strong Piotroski F-Scores (source: gurufocus.com):

🚨 Weak (0-3) – Companies With Financial Struggles

MicroStrategy (MSTR) – 2

Intel (INTC) – 3

These companies may have high debt, low profits, or cash flow problems, making them riskier investments.

⚖️ Stable (4-6) – Companies With Mixed Strengths

Tesla (TSLA) – 4

Hims & Hers (HIMS) – 5

Amazon (AMZN) – 6

These companies have some strong points, but there may be areas of concern investors should look into further.

✅ Strong (7-9) – Companies in Great Financial Shape

Apple ($AAPL) - 7

Mastercard ($MA) – 8

KLA Corporation ($KLAC) – 9

These companies are profitable, manage their finances well, and continue to grow efficiently.

How we use the Piotroski F-Score

At The Future Investors, we use the Piotroski F-Score as part of our research to check a company’s financial strength. While it’s not the only factor we consider, it helps us quickly spot strong businesses and avoid weaker ones.

Do you use the Piotroski F-Score in your investing strategy? Let us know in the comments!

Thank you for reading! 🙏

We put a lot of love into creating this post for you. If you enjoyed it, feel free to click the ❤️ button so more people can discover it on Substack.

Don’t hesitate to share your thoughts in the comments — we’d love to hear from you 💬

Disclaimer:

The information and opinions provided in this article are for informational and educational purposes only and should not be considered as investment advice or a recommendation to buy, sell, or hold any financial product, security, or asset. The Future Investors does not provide personalized investment advice and is not a licensed financial advisor. Always do your own research before making any investment decisions and consult with a qualified financial professional before making any investment decisions. Please consult the general disclaimer for more details.