🎓 How Many Stocks Should You Own?

Concentration or Diversification: The Timeless Portfolio Question.

Every investor asks at some point: How big should my portfolio be — just a few strong bets, or many positions?

Some choose concentration — a small, focused portfolio built on stocks they know inside out. Others prefer diversification — holding plenty of positions to spread risk and smooth out the ride.

At The Future Investors, we see both sides. Buffett made legendary concentrated bets on Apple and Coca-Cola, while index investors quietly built wealth for decades by owning the whole S&P 500.

Both strategies have strengths. Both have weaknesses. And both require a different mindset. But which approach actually works best? Let’s take a closer look — starting with the power of diversification.

🛡️ The Power of Diversification

Diversification means spreading your money so one bad stock can’t break you. It protects against the unexpected — fraud, new regulation, or an entire sector crashing.

It also makes your portfolio easier to hold. With less volatility, it’s simpler to stay invested when markets get rough. That peace of mind makes a big difference.

Diversification also lets you benefit from several trends at once. AI may be booming today, but healthcare or energy could be the leaders tomorrow. By holding more positions, you don’t have to predict the winner — you’ll already own it.

The classic example is the S&P 500. By owning the index, investors earned 8–10% per year on average for decades. Slow, steady, and powerful.

But as a retail investor, you’re not tied to the rules of an index or a fund. You don’t have to trim your winners just because they grow into a large part of your portfolio. That freedom means you can diversify broadly and still let your strongest positions run — something professionals can’t always do.

🎯 The Power of Concentration

Concentration is about putting more weight behind your very best ideas. Instead of owning dozens of stocks, you build a portfolio around the few you believe in most.

The upside is clear: if you’re right, the rewards can be huge. Warren Buffett and Charlie Munger often said that most of Berkshire Hathaway’s success came from just a handful of bets — like Apple, Coca-Cola, and American Express.

The same goes for individual investors. Those who went big on Amazon, Nvidia, or ASML early on saw life-changing returns, simply because they dared to hold a concentrated position and let it grow.

Concentration keeps things simple: with fewer positions, you can know each company inside out, follow the story closely, and invest with conviction. When it works, a few winners can shape your entire portfolio.

⚠️ The Downsides of Both Strategies

Both diversification and concentration have clear weaknesses.

Too much diversification can hold back your returns. If you own 50 or 100 stocks, even your best ideas won’t make much difference. This is what happens in many mutual funds: they end up looking almost identical to the index, but with extra fees on top. For individual investors, extreme diversification can feel safe but often leads to average results.

Too much concentration, can be painful if you’re wrong. A single Enron, Wirecard, or a mistimed bet on a popular stock can hurt your whole portfolio. With only a handful of positions, there’s very little room for error.

In short:

Diversification protects you, but may limit your upside.

Concentration can boost your winners, but also makes mistakes bigger.

🧠 The Psychology Behind the Choice

In the end, your portfolio isn’t just about numbers — it’s about psychology.

Diversification gives peace of mind. When you’re spread across many positions, a single bad stock won’t shake you as much. That makes it easier to stay invested through market ups and downs, which is often the most important factor for long-term success.

Concentration demands a very different mindset. You need deep knowledge, strong conviction, and the ability to hold on when markets turn against you. Not every investor is comfortable seeing 20% of their portfolio drop sharply in a single week — even if they believe in the company long term.

As an investor, ask yourself: Who am I? How do I deal with emotions? What is my temperament? Some investors sleep best knowing they own a little bit of everything. Others can handle volatility more easily, and believe that just a few strong bets are enough to drive their portfolio.

📈 What Really Works?

There is no one-size-fits-all formula in investing. Both diversification and concentration can work — and both can fail. A diversified portfolio protects you from being too wrong on a single stock or sector, while a concentrated portfolio can turn just a few winners into life-changing results.

The bottom line? Both strategies can outperform. Both can disappoint. Much depends on you as an investor — your knowledge, your temperament, and how you handle emotions when markets get tough.

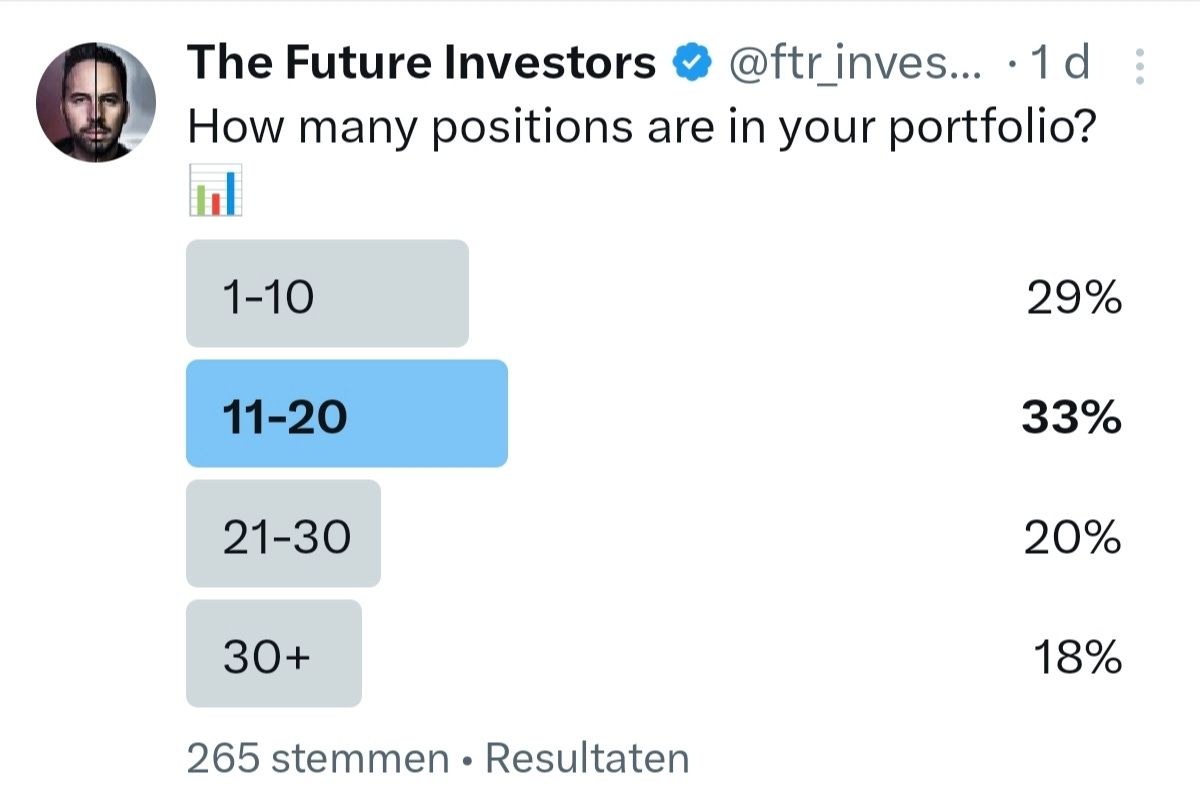

We ran a poll on X asking our followers how many positions they hold in their portfolio:

A total of 265 investors voted and the opinions are clearly divided.

Concentrated portfolios seem to have a slight edge — 11–20 positions was the most common answer (33%), with 1–10 close behind (29%). Still, many investors also prefer portfolios with more positions: 21–30 (20%) and 30+ (18%).

The takeaway? Investors think very differently about how many stocks to hold in their portfolio.

But what does the research say? Let’s take a look at what studies suggest about the ‘ideal’ number of positions in a portfolio.

🔮 The Magic Number

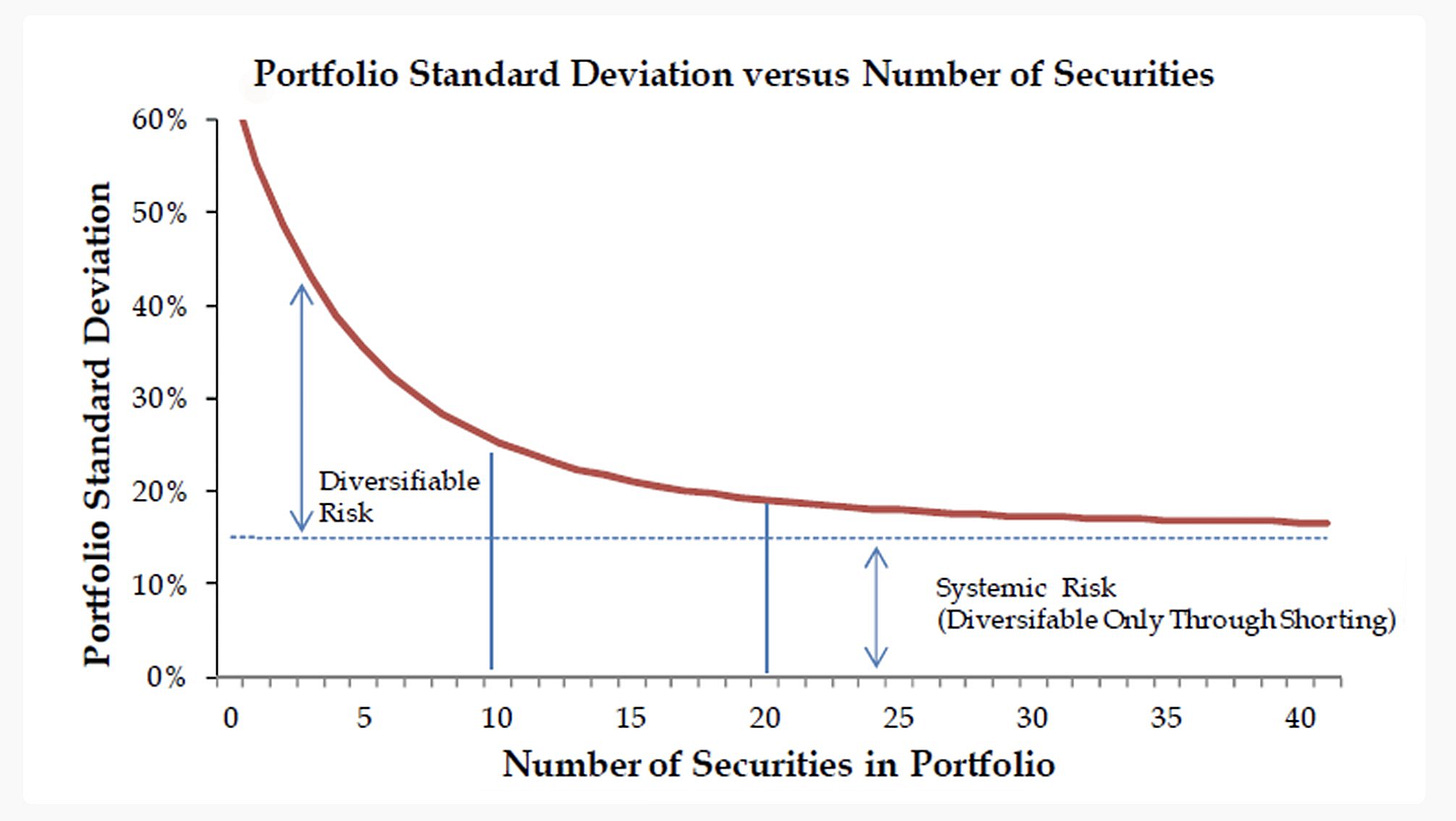

Research shows that the biggest benefits of diversification come fast. With 8–15 stocks, most company-specific risk is already reduced. From 15 to 20 positions you get a little extra stability — but beyond 20 stocks, the gains are limited.

As the chart below shows, most of the diversification benefit is captured early. By the time you hold around 15–20 stocks, the curve flattens — adding more positions only reduces risk by a tiny margin.

Source: Evans & Archer (1968), Fisher & Lorie (1970), Elton & Gruber (1977)

That’s why many studies suggest the sweet spot lies between 15–20 positions: enough diversification to protect you, while still concentrated enough for your best ideas to make a real impact.

Once you cross 30 positions, you’re essentially replicating the market. It feels safer, but it also means your upside looks more like an index fund — steady, but harder to truly outperform.

👉 In short:

Under 10 stocks = too concentrated, very high risk.

10–15 stocks = most of the risk reduction achieved, but still concentrated.

15–20 stocks = the sweet spot for risk/reward.

20–30 stocks = fully diversified, but with limited additional benefits.

30+ stocks = almost an ETF — safe, but little chance of real outperformance.

📌 Conclusion

According to studies, the sweet spot for diversification lies around 15–20 stocks. That’s where you balance protection and focus.

But the bigger lesson is this: there’s no one-size-fits-all formula. For some investors, their sweet spot might be fewer positions — for others, it could be more. It also depends on what kind of stocks you pick:

High-quality, profitable companies can be held with more conviction.

Riskier, unproven companies with little revenue or profit often require broader diversification.

What really matters is not just numbers, but behavior: how you deal with emotions when markets get rough.

Remember: both diversification and concentration can lead to outperformance. The key is to choose the approach that fits you best — the one that matches your temperament and still lets you sleep well at night.

🔥 Upgrade now to paid and get 30% off!

Unlock full access to all deep dives, our portfolios, every transaction — plus 350+ premium articles ✨

Upgrade for $329/year — that’s only $0.90 a day, and save $691 🔥

Cancel anytime ✅

Thank you for reading! 🙏

We put a lot of love into creating this post for you. If you enjoyed it, feel free to click the ❤️ button so more people can discover it on Substack or hit the ↪️ share button to share it with friends, family and fellow investors!

Don’t hesitate to share your thoughts in the comments — we’d love to hear from you 💬

That’s it for today.

We’ll see you again in the next edition of our newsletter!

Until then, invest wisely.

Vincent & Stefan

The Future Investors

Disclaimer:

The information and opinions provided in this article are for informational and educational purposes only and should not be considered as investment advice or a recommendation to buy, sell, or hold any financial product, security, or asset. The Future Investors does not provide personalized investment advice and is not a licensed financial advisor. Always do your own research before making any investment decisions and consult with a qualified financial professional before making any investment decisions. Please consult the general disclaimer for more details.