🎓 How to Beat the Market Where Most Fail

Most investors underperform. Here’s how you can win.

Beating the market looks simple. In reality, most investors underperform.

Over the past decades, the S&P 500 returned 7%-8%, while the average investor earned far less.

How is that possible? What does underperformance cost over the long term — and what can you do to improve your chances of beating the market?

In this article, we explore these questions through three parts:

👁️ The Reality: the cost of underperformance

🧠 The Cause: why investors underperform the market

🎯 The Solution: how you can beat the market

👁️ The Reality

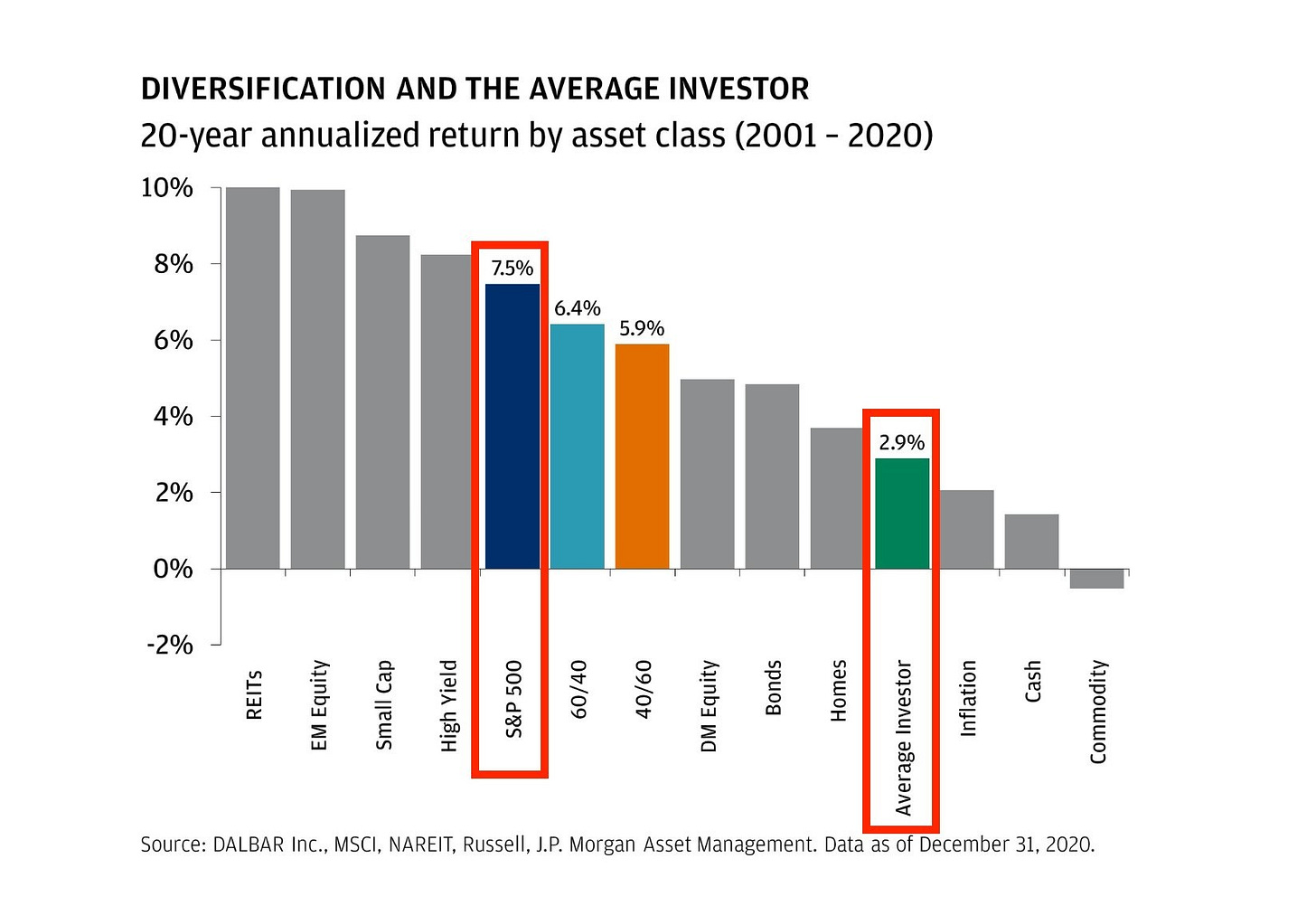

Research from J.P. Morgan Asset Management shows that over the 20-year period from 2001 to 2020, the S&P 500 delivered an average annual return of 7.5%, while the average investor earned just 2.9%. In other words: most investors don’t beat the market — they underperform it.

On paper, the difference between 7.5% and 2.9% looks small. In practice, it has a massive impact on long-term returns. Imagine you invest $10,000 today and add $1,000 every month, consistently, for 20 years.

These are the results in the same market:

S&P 500 at 7.5% → $598,339

Average investor at 2.9% → $342,588

That’s a $255,751 difference — created in the same market, without better access, and without any special information. Just different behaviour. This gap is known as the behaviour gap: the market delivers long-term returns, while investors capture far less of them.

The reality is simple: underperformance doesn’t cost a few percentage points — it costs years of compounding.

Upgrade now to paid and get 30% off!

Unlock full access to all deep dives, our portfolios, our monthly best buys — plus 350+ premium articles ✨

Upgrade for $329/year — that’s only $0.90 a day, and save $691 🔥

Cancel anytime ✅

🧠 The Cause

The gap between market returns and investor returns comes from one thing: behaviour.

The S&P 500 grows automatically over time. Most investors don’t — because they step out of the market for all kinds of reasons. Everyone has access to the same market.The result depends on how you act, not what you know.

Here are the eight main reasons why most investors underperform the market:

1️⃣ Selling during fear

When prices fall, selling feels like protecting your capital. In reality, it locks in losses just before markets recover.

2️⃣ Buying back later

People wait for “confirmation” that things are safe again. Which usually means buying higher than they sold.

3️⃣ Chasing performance

What just worked feels smart. So investors buy last year’s winners, not the next decade’s winners.

4️⃣ Switching strategies

From growth to value, from momentum to safety — driven by emotion. Every switch resets compounding, so nothing works long enough.

5️⃣ Trying to time the market

Looking for the perfect entry or exit rarely works. Missing just a few strong days can halve total returns.

6️⃣ Too much cash on the sidelines

Waiting for clarity — elections, recessions, headlines. Meanwhile, the market grows and cash doesn’t.

7️⃣ Overtrading

More trades feel like taking control. But frequent trading means more mistakes, more costs, less compounding.

8️⃣ Not knowing what you own

Many investors buy stocks they don’t truly understand. So when something happens — volatility, headlines, earnings — they can’t explain it and exit quickly. Without conviction, every dip feels like danger, not opportunity.

A painful pattern 😣

Each decision feels rational on its own:

“I’ll get back in later”

“I need to protect my gains”

“It’s safer to wait for confirmation”

“This time is different”

“Value is dead, I’m moving to high-growth”

“If it drops any further, I’m out”

But together they create a consistent pattern:

sell lower, buy higher, repeat

Every cycle interrupts compounding, which is why the average investor earns far less than the market return.

The problem isn’t the market. It’s behaviour.

🎯 The Solution

You don’t need to beat the market to do well. If you don’t want to fight it, owning the market is a smart strategy.

If you don’t have time to analyse companies yourself, owning the market is often the best option. A low-cost index like the S&P 500 gives you:

long-term growth

built-in diversification

strong historic returns

no stock picking or timing

It’s simple. It works. And it takes very little time.

In many cases, the S&P 500 beats the average stock picker anyway. So owning the index is not a “second-best” choice — it’s a great way to build wealth.

But if you do want to try and beat the market, it is possible. You just need to focus on the factors that actually drive better results over time: quality, conviction, and patience.

Here are six principles that will increase your chances of outperforming the index:

💎 Own quality businesses

Better results come from companies that grow and reinvest their own profits. Look for:

strong competitive position

high returns on capital

consistent cash flow

pricing power

a long path for growth

When a business compounds from the inside, the share price follows.

🔍 Know what you own

It’s much easier to hold a stock when you understand the business. Know:

how the company earns money

where the moat is

who the competitors are

how management uses capital

what the long-term story is

If you understand the business, price swings don’t feel like danger. Without understanding, every dip feels scary — and people sell too fast.

👤 Think like an owner

Traders follow price. Owners follow progress.

Owners don’t sell because the stock fell last week.

They ask: “Is the business improving?”

Ownership creates conviction — and conviction helps you stay invested.

⏳ Hold longer than feels comfortable

Compounding takes time, often years. The biggest gains usually come after long periods of holding, not from a quick trade.

If your holding period is one year, you’re not trying to beat the market —

you’re trying to predict it. Long time horizons reduce the need to be perfect.

🔁 Don’t interrupt compounding

Selling during fear resets the clock. Every time you step out of the market:

compounding stops

you wait for comfort

you buy back higher

Do that a few times in a decade, and the index wins easily. Staying invested does more work than being right.

📌 Stick to one strategy

You can’t beat the market by switching styles every year.

Value in one cycle, growth in the next, small caps after that…

That isn’t a strategy — it’s reacting to headlines.

Choose a simple approach you believe in and keep it through ups and downs.

Consistency beats trying to be clever.

Beating the market isn’t about finding secrets, it’s about avoiding the mistakes most investors make. Stay invested. Stay consistent. Let compounding do the work.

Most people try to win through action. The real edge comes from discipline, patience, and a process you can hold through every cycle. And if you want to do better than average — own quality businesses you understand, and give them enough time to compound.

Thank you for reading! 🙏

We put a lot of love into creating this post for you. If you enjoyed it, feel free to click the ❤️ button so more people can discover it on Substack or hit the ↪️ share button to share it with friends, family and fellow investors!

Don’t hesitate to share your thoughts in the comments — we’d love to hear from you 💬

That’s it for today.

We’ll see you again in the next edition of our newsletter!

Until then, invest wisely.

Vincent & Stefan

The Future Investors

Disclaimer:

The information and opinions provided in this article are for informational and educational purposes only and should not be considered as investment advice or a recommendation to buy, sell, or hold any financial product, security, or asset. The Future Investors does not provide personalized investment advice and is not a licensed financial advisor. Always do your own research before making any investment decisions and consult with a qualified financial professional before making any investment decisions. Please consult the general disclaimer for more details.