🎓 Markets Always Move in Waves – Learn to Ride Them

Markets sometimes feel crazy and unpredictable, but if you look closely, they often move in clear patterns.

In this article, you’ll learn about the different phases that every market goes through, explained in a simple and practical way. It’s not about predicting the future. It’s about recognizing what’s happening, so you can spot opportunities early and avoid costly mistakes. Master the waves, and you master the market.

Markets are like life: full of ups and downs

Stocks, housing, Bitcoin, everything moves in waves. Sometimes it feels like prices will only go up. Other times it feels like markets will never recover. This is completely normal. It’s called a market cycle. If you know what to look for, you won’t be surprised when things change. You don’t need to predict what’s coming next. You just need to recognize which phase we’re in. That’s your big advantage: staying calm when others panic.

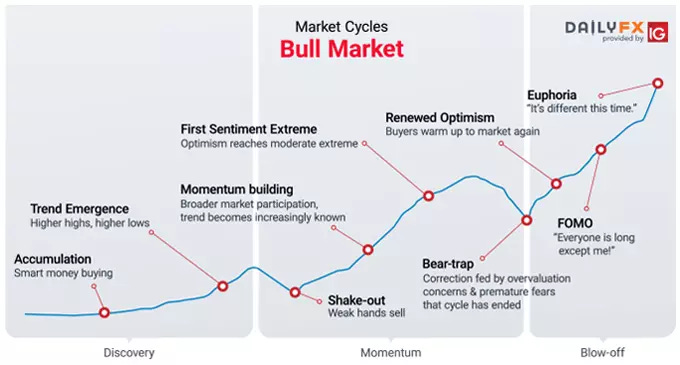

Most market cycles go through five phases. Let’s break down the 5 key phases, starting with the 3 phases of a bull market!

Bull Market

Source: DailyFX/IG

1. Discovery

The Discovery Phase is the quiet beginning, when no one is excited yet. People are still thinking about the last crash, but slowly, something new is beginning. It’s the best time to plant the seeds for future gains.

Duration: ⏳ ~25% of the cycle

Key signs:

Smart investors ("smart money") are the first to buy.

The trend is just starting, but most people are still scared or not paying attention.

Accumulation happens quietly behind the scenes.

Small drops ("shakeouts") scare out weak hands.

Patience is really important here.

Feeling: Cautious optimism 😌😊

Opportunity: If you invest here, you often buy before the big move up

2. Momentum

The Momentum Phase is when the market starts to feel better. Prices are rising steadily, more people are paying attention, and optimism is growing.

Duration: ⏳ ~35% of the cycle

Key signs:

The trend becomes visible.

Excitement grows, broader participation pushes prices higher.

Corrections happen but are healthy.

Sentiment is optimistic but not extreme.

Feeling: Growing confidence and excitement 😁😄

Opportunity: Ride the trend early before the crowd gets too excited.

3. Blow-Off

The Blow-off Phase is when the market gets risky. Excitement takes over, prices jump quickly, everyone tries to get in, and people stop thinking carefully.

Duration: ⏳ ~10% of the cycle

Key signs:

Everyone is talking about how much money you can make. From your neighbor to your hairdresser. FOMO takes over.

Prices shoot up fast.

People stop thinking and just chase gains.

Many believe "this time is different," ignoring all risks.

Smart money quietly start selling

Feeling: Euphoria and greed 🤩🤯

Opportunity: Start reducing risk, take some profits, and avoid chasing the crowd.

We covered the 3 bull market phases. Now let's dive into the 2 bear market phases!

Bear Market

Source: DailyFX/IG

4. Transition

The Transition Phase is when the mood shifts from bullish to bearish. Some people still believe prices will go higher, but growing doubt holds the market back. Buyers and sellers are in a constant push and pull.

Duration: ⏳ ~5% of the cycle

Key signs:

The market peaks after a strong run.

A sharp sell-off shakes investor confidence.

Many still believe it's just a normal correction.

Lower highs signal that the strength is fading.

Smart money starts to exit quietly.

Feeling: Uncertainty and denial 😕🤔

Opportunity: Protect your gains, raise cash, and prepare for bigger moves down.

5. Deflation

The Deflation Phase is when fear takes full control. Panic selling drives prices lower, and hope is replaced by fear.

Duration: ⏳ ~25% of the cycle

Reality sets in after months of denial.

Fear and panic drive heavy selling.

Even strong companies and good assets are sold off.

Dip-buying fails, each small rally gets crushed.

Media is filled with negative stories and blame games.

Value investors quietly start stepping back in.

Feeling: Fear and capitulation 😱😭

Opportunity: This is when brave, patient investors can find the best deals.

Know the phase, control the game

Knowing where you are in the cycle can make a big difference in how you invest. It helps you see what most people miss and stops you from making mistakes that cost a lot of money.

When you understand the different phases, you don’t panic when prices fall. You also don’t get too excited when everything is going up. You stay calm, stay patient, and make better choices while others lose control.

It’s not about trying to guess what will happen tomorrow, no one can do that. It’s about looking at the signs and making simple decisions based on what’s happening in the market.

When you see signs of hype, you know it’s time to be careful. When there is fear everywhere, you know it might be time to get interested. Your real advantage is not guessing the future, but staying calm when others are emotional. That’s when the best opportunities come and when you avoid the biggest risks.

As Warren Buffett says:

"Be greedy when others are fearful, and fearful when others are greedy."

And that’s why knowing the cycle gives you the advantage.

So…where are we right now?

Looking at the markets right now, we believe we’re somewhere between the Transition Phase and the early Deflation Phase. Markets are struggling to reach new highs, big tech stocks are showing clear weakness, and the news is becoming more negative by the week. At the same time, more investors are moving into cash, holding back, and showing real signs of fear.

Markets will always move in waves. You can't control it. You can't stop it. But recognizing the cycle and staying calm can make a big difference over time.

Stay focused, stay patient, and trust the journey. Wishing you lots of success and confidence as you ride the waves ahead!

The Future Investors

Thank you for reading! 🙏

We put a lot of love into creating this post for you. If you enjoyed it, feel free to click the ❤️ button so more people can discover it on Substack.

Don’t hesitate to share your thoughts in the comments — we’d love to hear from you 💬

Disclaimer:

The information and opinions provided in this article are for informational and educational purposes only and should not be considered as investment advice or a recommendation to buy, sell, or hold any financial product, security, or asset. The Future Investors does not provide personalized investment advice and is not a licensed financial advisor. Always do your own research before making any investment decisions and consult with a qualified financial professional before making any investment decisions. Please consult the general disclaimer for more details.