🔍 The Software Reset: Who Survives?

AI is pressuring software stocks. Discover who’s most at risk and who is likely to win.

AI developments are putting software stocks under heavy pressure. In this article, we look at which software companies are most at risk and which are best positioned, by dividing them into four categories 👇

🔄 The Replaceables

Software that AI can replace faster than most expect.

🍋 The Squeezed

Software that stays in use but faces pressure on growth and pricing.

⚓ The Anchors

Mission-critical software that stays essential, without faster growth from AI.

🏆 The Beneficiaries

Software that directly benefits from AI and sees growth accelerate.

📉 What Happened?

Software stocks have been under pressure for months. Last week, the pressure increased, resetting the entire sector. The trigger was a wave of new developments around AI agents, plugins, and end-to-end workflows.

The launch of Claude Cowork, together with 11 new AI plugins, showed how fast work is shifting away from individual software tools. With these plugins, AI can now find new leads, review contracts, and prepare financial reports. Users no longer have to move between different apps. They explain what needs to be done, and the AI plans the steps, does the work, and takes care of follow-up.

OpenAI Frontier shows the same trend: AI built for companies that can plan tasks and get things done across multiple tools.

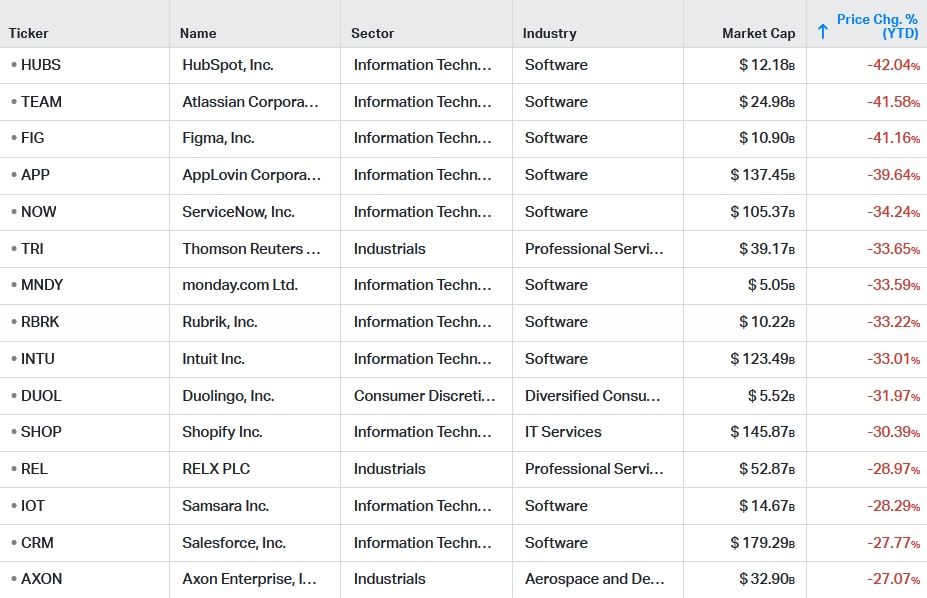

The reset hit many parts of the software sector, from enterprise software and design tools to productivity platforms and data analytics. There was no distinction between more speculative names and high-quality software — everything was sold. Because of the scale of the sell-off, the decline is now being called the “SaaSpocalypse.”

Below is an overview of the stocks that have been hit hardest year-to-date 👇

Source: Koyfin

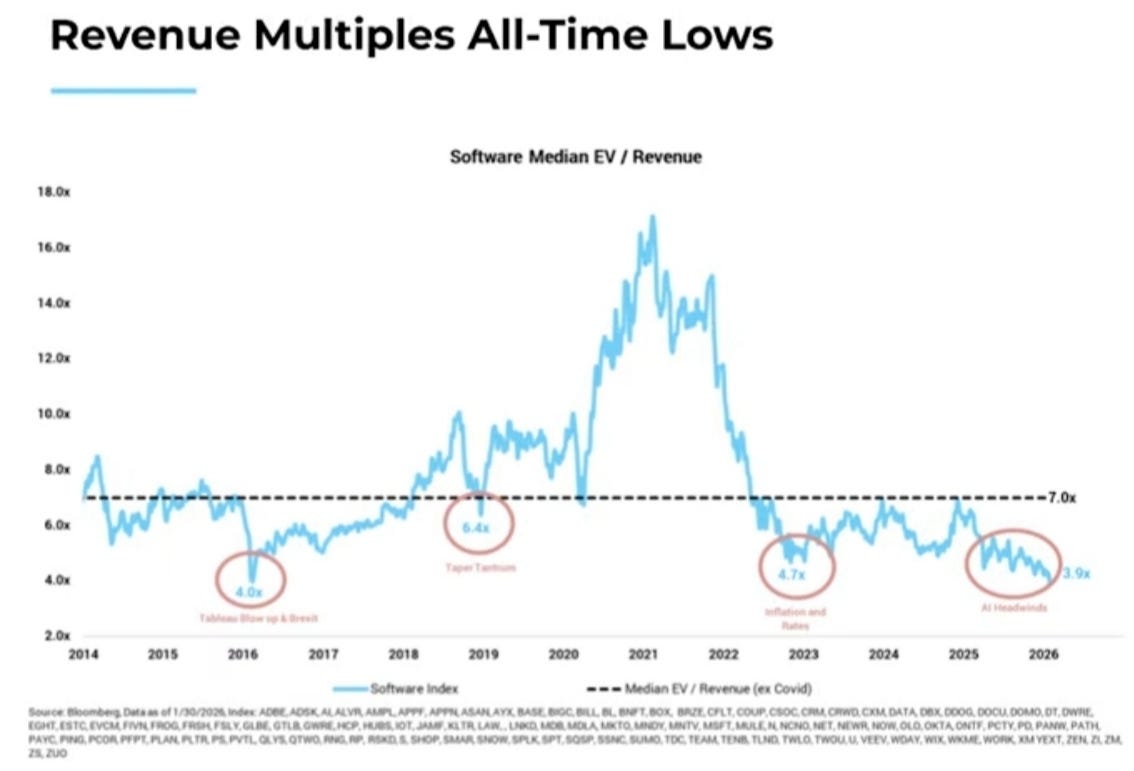

After these declines, valuations of software stocks are much lower. The median EV/Revenue multiple now stands at 3.9x, the lowest ever. The EV/FCF (NTM) tells a similar story, currently trading at 25x — also an all-time low.

Source: Altimeter Capital Management

🏷️ Why Software Is Being Re-Priced

This reset is not just about falling share prices. It reflects a real shift in how software creates value in an AI-driven world.

For years, the SaaS model was simple: more users inside the tool meant more seats, more revenue, and steady growth. AI breaks that link. If AI agents can draft, analyze, schedule, and follow up, fewer people need to log in and do the work themselves. And when fewer humans are active inside the product, seat-based growth slows down.

At the same time, customers start to think differently about pricing. They don’t want to pay for a growing number of seats if an AI agent can do the job. They want to pay for the task or the result. That changes pricing power. It becomes harder to raise prices, harder to expand revenue per customer, and easier to replace multiple tools with one AI-driven workflow.

This also changes who controls the workflow. AI agents increasingly decide which tools to use and when. In many cases, software becomes the “back-end,” while the AI layer becomes the main interface. That shift matters, because the company that owns the workflow captures more of the value.

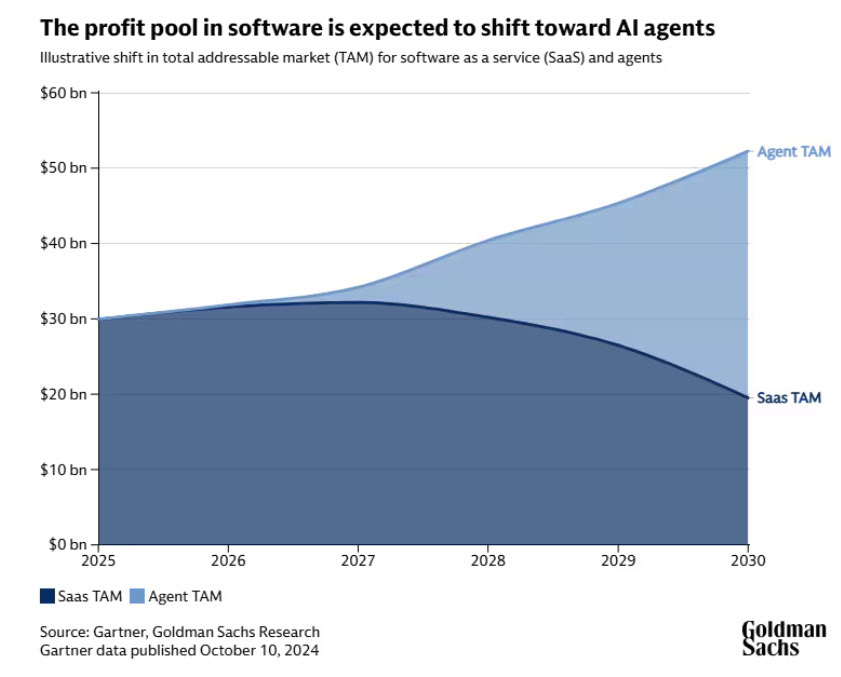

This shift is also visible in the changing total addressable market for software in the coming years. As the chart below shows, value is increasingly moving from traditional SaaS toward AI agents.

Source: Gartner, Goldman Sachs Research

So the market is re-pricing software. Not because software is dead, but because not all software will matter in the same way. Some products will be replaced. Others will stay in place but see slower growth as pricing power and margins come under pressure. There are still clear winners. Mission-critical platforms that are deeply embedded will remain essential. And a smaller group will benefit directly from AI, where demand and growth can accelerate.

That brings us to the key question: which software companies will survive?

Which are most at risk and which can win in an AI-driven world?

To answer that, we divide software companies into the following four categories:

🔄 The Replaceables

Software that AI can replace faster than most expect.

🍋 The Squeezed

Software that stays in use but faces pressure on growth and pricing.

⚓ The Anchors

Mission-critical software that stays essential, without faster growth from AI.

🏆 The Beneficiaries

Software that directly benefits from AI and sees growth accelerate.

This content is available exclusively to our paid subscribers ✨

SPECIAL DEAL: 30% OFF! 🎁🔥

Get instant access to this Insights article, our Portfolios, our Best Buys, all Deep Dives — plus 375+ premium articles to explore!

✅ Already trusted by 4,300+ investors.

Upgrade now to discover in which category we place each software company 🔓

Let’s start with “The Replaceables”.

🔄 The Replaceables

The Replaceables are the highest-risk group within software. These are companies whose products are easiest to replace by AI agents.