🔍 UnitedHealth’s Meltdown: Opportunity or Trap?

The largest U.S. health insurer lost over $288 billion in market value in just one month. Unique buying chance — or major red flag?

UnitedHealth Group UNH 0.00%↑ is an American healthcare company offering both health insurance and medical services through its subsidiaries UnitedHealthcare and Optum. With over 50 million insured members and $400 billion in revenue in 2024, it’s one of the largest healthcare companies in the world.

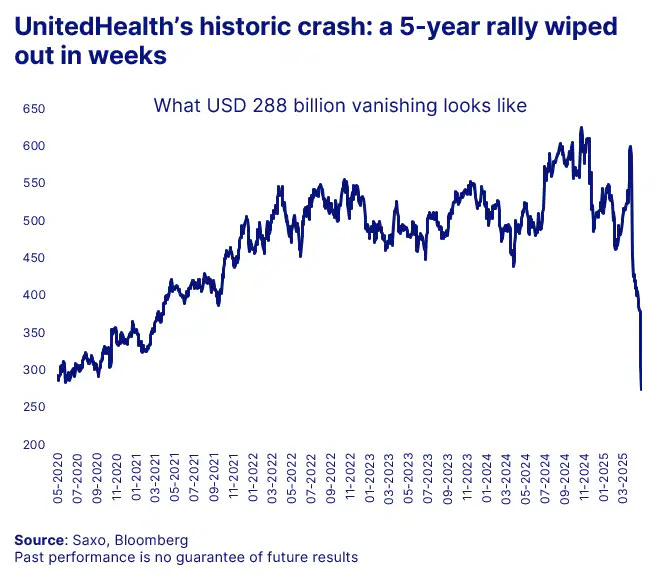

But right now, the company is facing massive pressure. The stock has dropped almost 54% from its peak, with 50% of that loss happening just in the past month. Thursday, shares fell to their lowest level since April 2020. In just a few weeks, UnitedHealth’s market value has been cut in half, now sitting below $265 billion. The last time the stock saw a decline this steep over such a short period was back in 1998, when a surprise $900 million charge disrupted a planned merger with rival Humana.

Yesterday, UnitedHealth bounced back slightly, rising over 6% after news broke that several board members had bought shares, giving investors a bit more confidence after the recent selloff.

So, what’s really going on at UnitedHealth Group? Once a market favorite, now under pressure. Is this a unique buying opportunity for investors or are the risks simply too high?

Source: SaxoBank, Bloomberg

In this insights article, we’ll take you through the key events in chronological order. What has happened so far? What’s still unclear? How is the company currently valued? And finally, how do we look at UnitedHealth as a potential investment in this uncertain phase?

What happened at UnitedHealth?

UnitedHealth’s decline didn’t come out of nowhere, but once things started to go wrong, the drop in confidence and share price happened incredibly fast. Here is a chronological overview of the key events:

April 17 – Disappointing quarterly earnings

On April 17, UnitedHealth Group reported its Q1 2025 earnings. While revenue and earnings were slightly higher than last year, they fell short of analysts’ expectations. As a result, the company lowered its full-year 2025 earnings forecast from $29.50–$30.00 per share to $26.00–$26.50 per share. The main reason was that medical costs, especially within the Medicare Advantage program, were much higher than expected.

Following the earnings release, the stock price dropped sharply by 22% in a single session, the biggest one-day fall in over 26 years. CEO Andrew Witty said that despite growth, the results fell short of expectations and were concerning.

May 13 – CEO steps down and 2025 outlook suspended

On May 13, UnitedHealth surprised the market again when CEO Andrew Witty suddenly stepped down for “personal reasons.” On the same day, the company suspended its full-year 2025 financial outlook because medical costs remained higher than expected. A move that rarely happens without a serious reason. To help rebuild trust with investors, former CEO Stephen Hemsley stepped back in to lead the company during this difficult time. In a public statement, Hemsley said:

“I am deeply disappointed in our performance. We need to improve quickly and with focus.”

May 15 – Criminal investigation announced

And then, on top of these developments, yesterday The Wall Street Journal reported that the US Department of Justice has opened a criminal investigation into possible fraud within UnitedHealth’s Medicare Advantage division. The exact details of the allegations are still unclear. Following this news, the stock price dropped by another 13%.

Because of these events, the stock has fallen by 53% since mid-April. Analysts warn that UnitedHealth could potentially be removed from the Dow Jones if the situation doesn’t improve. Investors are concerned about reputational damage, legal risks, and growing political pressure.

What don’t we know yet?

Despite recent developments, some important questions are still unclear:

What exactly is the criminal investigation about?

Will there be fines or legal charges?

Can regulators and customers regain their trust?

What impact will new rules and tougher oversight of Medicare Advantage have?

Only once the answers to the above questions are known can we understand the exact impact on UnitedHealth’s business model.

Is the valuation attractive?

Now that we understand what’s been happening and recognize that some key questions are still unanswered, it’s time to take a closer look at the valuation of UnitedHealth’s stock.

At first glance, UnitedHealth looks like a bargain:

The current P/E ratio is 12.2

The 10-year median is around 21.9

Just looking at the numbers, you might think it’s a great deal. But investing isn’t that simple.

A low valuation alone doesn’t say much about the company’s quality. When the fundamentals are uncertain, metrics like the P/E ratio lose their meaning. As the saying goes: “cheap can get cheaper,” especially if growth doesn’t return in 2026 as well.

Why we’re staying away: the red flags

At UnitedHealth, we currently see too many red flags:

The sudden departure of the CEO without a clear succession plan.

A criminal investigation that could result in reputational damage or hefty fines.

The complete withdrawal of the company’s outlook: a rare and troubling signal.

Significant stock volatility and the potential loss of blue-chip status.

Heavy reliance on Medicare at a time of increasing political and public scrutiny.

Strategic overreach in Medicare Advantage, unlike some competitors who are more cautious.

An uncertain future due to increased regulation and the risk of structural changes in the market.

We only invest in high-quality companies. UnitedHealth has never been a potential investment candidate for us, and the current situation doesn’t change that. Actually, because of all these red flags, we’re now even more likely to avoid this stock.

It’s easy to see a stock that’s been cut in half and has a low valuation and think, “This must be a great buying opportunity.” And for some traders, this setup, with oversold technicals and a sharp drop in sentiment, might offer a chance for a short-term rebound. But long-term investing is about much more than just the price — it’s about trusting the leadership, understanding the strategy, and believing in the company’s quality.

Right now, UnitedHealth falls short in all these areas.

So our conclusion is simple: we’re staying far away from this stock. As the saying goes:

“The best investment decision is sometimes the one you don’t make.”

Good luck, and invest wisely.

The Future Investors

Source: UnitedHealth Group First Quarter 2025 Results

The Future Investors (Vincent & Stefan) currently do not hold a position in UnitedHealth Group.

Thank you for reading! 🙏

We put a lot of love into creating this post for you. If you enjoyed it, feel free to click the ❤️ button so more people can discover it on Substack.

Don’t hesitate to share your thoughts in the comments — we’d love to hear from you 💬

Disclaimer:

The information and opinions provided in this article are for informational and educational purposes only and should not be considered as investment advice or a recommendation to buy, sell, or hold any financial product, security, or asset. The Future Investors does not provide personalized investment advice and is not a licensed financial advisor. Always do your own research before making any investment decisions and consult with a qualified financial professional before making any investment decisions. Please consult the general disclaimer for more details.

As long as the lawsuit hasn't been settled and a new CEO hasn't outlined his/her plans for the company, it's not a bargain. The selling was extreme, however. Tradaing UNH is fine. Investing in it long-term? I wouldn't do that.

Good article, you covered ongoing events clearly :)