📦 Unpacked #1: McDonalds

Our In-Depth Fundamental Analysis & Final Score of McDonalds ⭐

Welcome to another edition of Unpacked, our monthly series where we explore a different company in detail. Each month, we break down its story, business model, and highlight the latest developments.

Additionally, we do a detailed fundamental analysis, diving into the company’s management, market, financials, and growth estimates. We score each area separately, leading to a final score between 0 and 100. This score reflects how fundamentally attractive we believe the company is as an investment, ranging from:

🔴 Below 50 → Uninvestable

🟠 50 - 59 → Questionable

🟡 60 - 69 → Reasonable

🟢 70 - 79 → Quality

🔵 80 - 89 → High-Quality

🟣 90 or above → Exceptional

The goal? To give you a full deep dive into this company, as a complement to your own research, so you can decide if it’s the right investment for you.

We’re kicking off our first Unpacked with a name almost everyone knows: McDonald’s. Famous for its golden arches, McDonald’s is the largest fast-food chain in the world, with more than 41,000 restaurants spread across over 100 countries. From its beginnings as a small drive-in burger restaurant to becoming the global leader in fast food, McDonald’s has mastered the art of scaling a simple concept into a massive business.

What drives McDonald’s success? Is it the strength of its brand, its ability to innovate, or its strong financial strategy? And most importantly — should McDonald's stock be on your radar as an investor?

Now let’s unpack the fundamentals of this fast-food giant — and check out how we score it!

History and Business Model

It all started in 1940 when brothers Richard and Maurice McDonald opened a small restaurant in San Bernardino, California. However, it wasn’t until 1954 that Ray Kroc, a milkshake machine salesman, became inspired by the financial success of the McDonald brothers' concept and began collaborating with them. Kroc saw the potential in their simple, fast-service system and helped turn it into a global brand. In 1955, the McDonald's Corporation was founded. Kroc was frustrated because the brothers were unwilling to expand their chain of just a few restaurants, so in 1961, he purchased the company from them for $2.7 million. While Kroc transformed McDonald's into a worldwide giant, the core principles of the business have largely remained unchanged from those the McDonald brothers established in 1948. We highly recommend watching the movie The Founder, as it shows this fascinating history in a great way!

A key factor in McDonald's success is its franchise model. Most McDonald's locations (around 93%) are owned and operated by franchises. McDonald’s buys the land or property where the restaurant is located and then leases it to franchisees. They make money through rent and a percentage of the restaurant's sales. This model makes McDonald’s less dependent on the sales of each individual restaurant and more focused on the steady income from its franchises.

McDonald’s is often seen as a real estate business because of its significant investment in property. The company owns a large portfolio of land and buildings, which it leases to franchisees. This real estate gives McDonald’s a strong financial base, as the value of its properties keeps increasing over time.

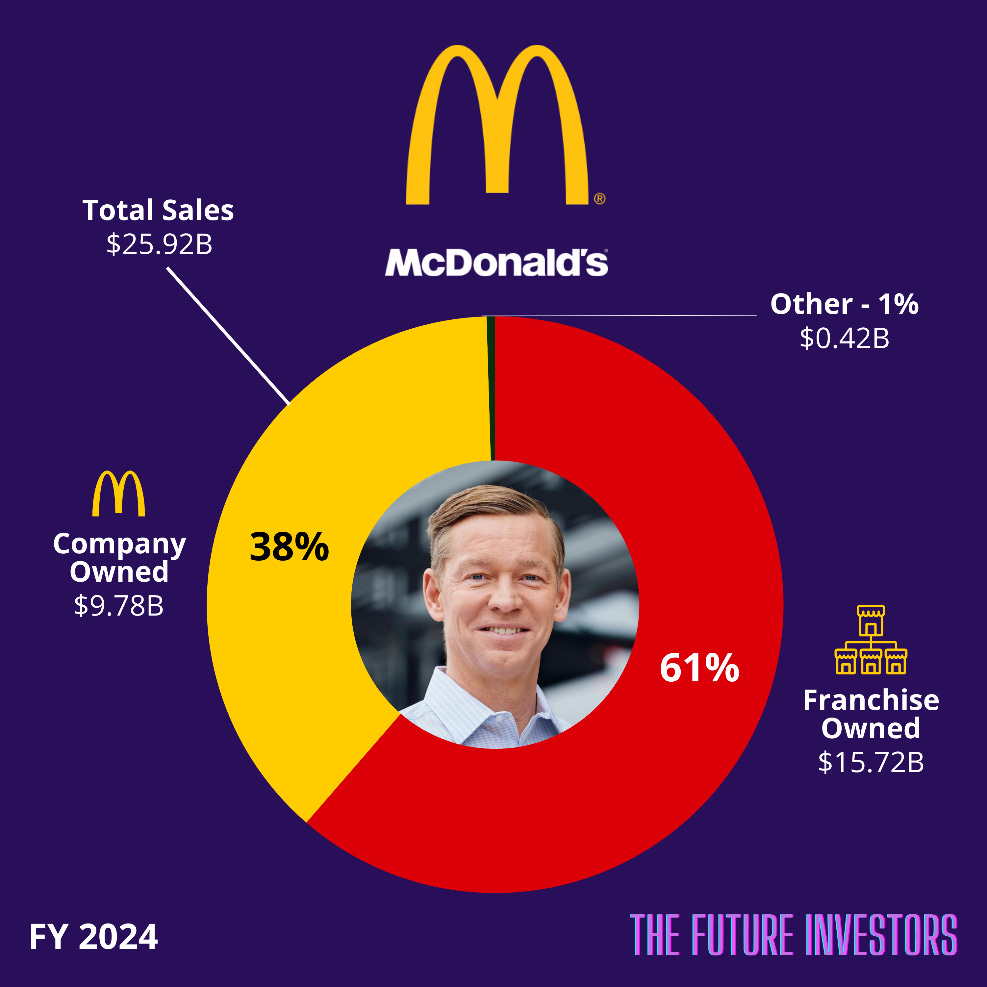

Revenue Breakdown

In 2024, McDonald's generated a total revenue of $25.92 billion. This revenue can be broken down into three key categories:

Franchise Owned (61%): This portion represents the revenue McDonald's earns from franchised restaurants. Franchisees operate the restaurants and pay a percentage of their sales to McDonald's as part of the franchise agreement.

Company Owned (38%): This is the revenue generated from McDonald's own restaurants, which are directly operated and managed by the company itself.

Other (1%): This category includes additional revenue from various business operations not directly related to restaurant sales.

Recent Developments

Over the years, McDonald's has continuously shown that it can adapt to changing customers' needs. Below are the most significant recent developments:

The $5 Meal Deal

McDonald’s introduced the $5 Meal Deal last year as a strategy to attract price-sensitive customers. This move responds to growing competition in the fast-food market and rising inflation, offering cheap options for customers looking for good meal deals.CosMc’s: A New Beverage Venture

McDonald’s has launched CosMc’s, a new space-themed concept targeting the growing beverage market. With 75% of Starbucks' revenue coming from cold drinks, McDonald’s sees a major opportunity to compete by offering premium options like iced coffees, lemonades and other specialty drinks. The first location opened on December 7, 2023, in Bolingbrook, Illinois. McDonald's is also testing the concept in several locations across Texas. Fun fact: the name CosMc's is inspired by a alien character from McDonald’s commercials in the late 1980s.Source: CosMc’s / BuzzFeed

Digitalization and AI in Drive-Thrus

McDonald’s is using AI in its drive-thrus to make ordering faster and easier. For example, McDonald's has introduced AI-powered voice-recognition at some locations that can understand customers and take orders automatically. This system can have conversations with customers, accurately record their orders, and, in some cases, even make recommendations based on previous orders or popular menu items. These updates are meant to make the customer experience smoother and more convenient.New Menu Options and Healthier Choices: McDonald's has changed its menu to include healthier options and plant-based alternatives, like the McPlant burger. This meets the growing demand for healthier and more sustainable food choices.

Expansion into Emerging Markets

McDonald’s has set ambitious growth targets, targeting 50,000 restaurants worldwide by 2027. A big part of this growth will happen in countries/regions like India, Southeast Asia, and Africa, where there is a lot of potential for new customers. By opening more restaurants in these regions, McDonald’s hopes to bring its food to more people and grow its global presence.

These efforts show that McDonald’s is focused on staying up-to-date, adjusting to new trends, and expanding into new markets to remain the leader in the fast-food industry.

Fundamental Analysis

In the fundamental analysis, we evaluate three key areas: management, market, and financials & growth estimates. Each aspect is scored individually, leading to a final score between 0 and 100, ranging from uninvestable to exceptional.

Management (max 25 points):

CEO/Founder: 10 points

Glassdoor: 5 points

Historical management strength: 10 points

Market (max 35 points):

Leadership & competition: 10 points

Moat (competitive advantage): 15 points

Total Addressable Market: 10 points

Financials & Growth Estimates (max 40 points):

Revenue growth: 11 points

EPS growth: 7 points

Gross margin: 5 points

Net margin: 4 points

Free Cash Flow (FCF) yield: 3 points

Return on Invested Capital (ROIC): 3 points

Debt to Equity Ratio: 3 points

Earnings result: 4 points

Finally, we check if the stock meets certain criteria (as we believe these carry more risks), and points will be taken off for the following factors:

Chinese company: -10 points

Chinese companies receive -10 points because of higher geopolitical risks, unpredictable regulations, and limited transparency.High cyclical or high-risk sectors: Banks, Biotech, Energy, or Commodities: -10 points

High cyclical or high-risk sectors receive -10 points because they are more sensitive to economic downturns and market volatility.Geopolitical risk: -5 points

Geopolitical risk receives -5 points because it can lead to instability, affecting market performance and company operations.Small and Micro-cap stocks: -5 points / -10 points

Small-cap stocks with a market cap < 2 billion receive -5 points and Micro-cap with a market cap < 300 million receive -10 points, because smaller companies often face higher volatility, limited financial resources, and more difficulty accessing capital.Altman Z and Piotroski-F: -4 points / -2 points

The Altman-Z score and Piotroski-F score are financial models used to assess a company's financial health. The Altman-Z score predicts the likelihood of bankruptcy based on balance sheet ratios, while the Piotroski-F score evaluates financial strength through profitability, liquidity, and operational efficiency. A low Altman-Z or Piotroski-F score indicates weak financial health, suggesting a higher risk of financial distress or bankruptcy. For this reason, we deduct points from companies with low scores. When the Altman-Z score is <= 1.8, it falls in the Distress Zone, and the company receives -4 points. An Altman-Z score between 1.8 and 3 places the company in the Grey Zone, resulting in a deduction of -2 points. If the Altman-Z score is >= 3, the company is in the Safe Zone and receives no deduction. For the Piotroski-F score, a score between 0 and 3 indicates poor financial health, and the company receives -2 points. A score between 4 and 6 is considered stable, while a score of 7 or higher is considered good, with no deduction in points for these companies.

Final Scoring

To determine the investment potential of a stock, we use the following rating scale based on the final score:

🔴 Less than 50 → Uninvestable

🟠 50 - 59 → Questionable

🟡 60 - 69 → Reasonable

🟢 70 - 79 → Quality

🔵 80 - 89 → High-Quality

🟣 90 or above → Exceptional

Unlock the full fundamental analysis below and see how we score McDonalds on a scale from 0 to 100 — exclusive available for our premium members! 🚀

1. Management

1.1 CEO and Founder

The current CEO of McDonald’s is Chris Kempczinski, who has been in charge since November 2019. He took over the role after the departure of Steve Easterbrook and became the Chairman of the Board in 2024. Kempczinski has a background in business leadership and has worked with McDonald’s for several years before stepping into the CEO position. He is not one of the company's founders but has played a key role in continuing McDonald's growth and innovation. Under his leadership, the company has focused on expanding its digital and delivery services and continuing its global reach.

1.2 Glassdoor

Employee reviews on Glassdoor show mixed feedback. While McDonald’s remains one of the most recognized brands worldwide, the company has received a Glassdoor rating of 3.5 out of 5 stars. This suggests that while the company is strong in many areas, there are still some concerns about employee satisfaction. Chris Kempczinski’s CEO approval rating stands at 72%, which shows a solid level of support from employees, though there is still room for improvement.

1.3 Historical Management Strength

McDonald's management has consistently proven its ability to adjust to changing circumstances, maintaining its position as a market leader. For example, the introduction of the breakfast menu and later All-Day Breakfast helped boost revenue.

Recent innovations include self-order kiosks, a popular app, and delivery partnerships with services like Uber Eats, which were crucial during the pandemic. McDonald's has also used AI, like dynamic drive-thru menus that offer personalized recommendations.

Additionally, the company has responded to sustainability demands with eco-friendly packaging and plant-based options like the McPlant. These efforts reflect the leadership’s focus on staying relevant in a fast-changing industry.

1.4 Scoring

The company is no longer led by its founders, and the founders are not involved anymore in the business. The current CEO has been in position for 5 years. Based on this we give the company a score of 4 out of 10.

The Glassdoor rating of 3.5 and CEO's approval rating of 72% result in a score of 3 out of 5.

The management has demonstrated over the years its ability to consistently adapt to changing circumstances while maintaining its position as a market leader. For this reason, we give McDonald's the maximum score of 10 out of 10 for Historical Management Strength.

This result in a total management score of 17/25 🟡

2. Market

2.1 Leadership & Competition

In the highly competitive fast-food restaurant industry, McDonald's is widely considered the global leader. With over 41,000 locations in more than 100 countries, McDonald's maintains the largest global presence in the fast-food sector.

That being said, other significant players also hold substantial market shares, such as:

Subway, with the largest number of locations globally (over 40,000), although it operates in a slightly different segment of the fast-food industry (subs and sandwiches).

YUM! Brands, which owns Taco Bell, KFC, and Pizza Hut, is a major player with a vast global reach.

Burger King, a direct competitor to McDonald's, continues to challenge McDonald’s leadership, particularly in certain regions.

However, in terms of total revenue, brand recognition, and worldwide presence, McDonald's remains the leader in the fast-food restaurant industry.

2.2 Moat

McDonald's has a strong "economic moat," which refers to the competitive advantages that protect it from rivals and help maintain its market position. Here's a breakdown of McDonald's most strong competitive advantages:

1. Brand Recognition & Loyalty

McDonald's has one of the most recognizable brands globally, built over decades. The golden arches are iconic, and its strong global presence creates significant customer loyalty. This powerful brand identity ensures McDonald's can attract customers consistently, even in competitive markets.

McDonald's also holds a unique position by attracting customers from all layers of society. From wealthy individuals to those with limited income, McDonald's is widely seen as an accessible and affordable dining option. This broad demographic appeal makes McDonald's less affected by trends that impact only specific customer segments.

2. Global Scale and Network

McDonald's operates in over 100 countries, with thousands of locations worldwide. This global scale provides a massive cost advantage in sourcing ingredients, advertising, and logistics, allowing McDonald’s to maintain competitive pricing and availability.

3. Franchise Model

McDonald's franchise model is a core competitive advantage. It allows rapid expansion without taking on all the operational costs and responsibilities, enabling McDonald's to grow rapidly while maintaining a relatively low level of capital expenditure. Additionally, this model makes McDonald's less dependent on direct sales from the restaurants, as a significant portion of its revenue comes from franchise fees and real estate. This creates a more stable income stream, even during periods of economic downturn.

2.3 Total Adressable Market

McDonald's operates in the global fast-food industry, which is a massive market worth over $600 billion. As one of the largest players in the sector, McDonald's has a significant share of this Total Addressable Market. While McDonald's continues to expand in emerging markets and explore new business opportunities, its growth potential is somewhat limited because they already hold a significant portion of the market. Despite this, they still have an ambitious target of 50,000 restaurants by 2027. We believe this target is overly ambitious, given the scale they’ve already achieved. However, the company can still find growth opportunities in areas such as digital innovation, delivery services, and menu diversification, which could allow it to further strengthen its position in a saturated market. We also believe that the launch of Cosmc’s is a smart move to capture market share in the growing beverage market.

2.4 Scoring

We give McDonald's a 8 out of 10 for leadership and competition because, while the company remains the global leader with over 41,000 locations, it operates in a highly competitive market and faces significant competition from brands like Burger King and YUM! Brands. Ideally, we prefer companies in markets with a monopoly (e.g., ASML's dominance in the extreme ultraviolet (EUV) lithography market) or a duopoly (e.g., VISA and Mastercard's control over the global credit card payment market).

Due to McDonald's strong brand recognition, global scale, and highly effective franchise model, the company benefits from loyal customers and significant cost advantages. These factors make it difficult for competitors to challenge McDonald's dominance in the fast-food industry. As a result, we give McDonald's a high score of 14/15 for its moat.

We give McDonald's a 4 out of 10 for Total Addressable Market because, with a large market share already captured, its growth potential is limited comparing with new more upcoming food concepts. While there are opportunities for expansion in emerging markets like Asia and through innovation and diversification, the market is becoming saturated. This makes rapid growth, especially in more developed markets, challenging. Though we see potential in CosMc’s to capture market share in the beverage market

This result in a total market score of 26/35 🟢

3. Financials & Growth Estimates

3.1 Revenue Growth

McDonald's has demonstrated stable revenue growth and continues to expand globally. According to analyst forecasts, revenue is expected to grow at a CAGR of 4.8% over the next three years (source: Koyfin). While this is not explosive growth, it reflects McDonald's ability as a market leader to steadily increase its revenue, driven by pricing strategies, digital innovation, and global expansion.

3.2 EPS Growth

Earnings Per Share (EPS) growth is a key indicator of a company’s profitability and financial health. For McDonald's, analysts are forecasting an EPS growth rate of 7.6% CAGR over the next three years (source: Koyfin). This reflects the company’s strong operational performance and its ability to effectively manage costs, maintain margins, and generate higher profits despite potential challenges.

3.3 Gross Margin

McDonald's has a gross margin of 56.8% (LTM) (source: Koyfin), which is significantly higher than the industry average, typically ranging from 15% to 30% in the fast-food sector. This high margin is driven by McDonald's franchise model, which allows the company to keep direct operational costs low while generating strong revenue. Additionally, McDonald's benefits from economies of scale, efficient cost management, and strong pricing power. These factors help maintain a high gross margin.

3.4 Net Profit Margin

McDonald's net profit margin of 31.7% (LTM) (source: Koyfin) is impressive! In our opinion, this high margin highlights the company’s ability to turn revenue into actual profit effectively. With its efficient operations, strong brand, and franchise model, the company has managed to keep costs low and maintain high profitability. When compared to the industry average, McDonald's stands out, showing strong financial discipline and resilience even in challenging market conditions.

3.5 Free Cash Flow (FCF) yield

McDonald's free cash flow yield of 3.1% (LTM) (source: Koyfin) shows how efficiently the company generates cash relative to its market cap. This metric indicates McDonald's ability to convert revenue into free cash flow after expenses. In our view, a 3.10% yield is solid, reflecting the company's strong cash generation, which supports dividends, share repurchases, and investments. While not exceptionally high, it highlights McDonald's financial strength and its capacity to return value to shareholders.

3.6 Return On Invested Capital (ROIC)

McDonald's generates strong returns on its investments, as shown by its ROIC of 20.3% (LTM) (source: Koyfin). In our view, this is a clear indication that the company is using its capital efficiently. A return of 20.3% is well above the cost of capital, which highlights McDonald's strong financial management and operational effectiveness.

3.7 Debt to Equity Ratio

McDonald's has a negative book value of -$3.80 billion and total debt of $51.99 billion, resulting in a negative debt-to-equity ratio of -13.68. This is because the book value (equity) is negative, meaning that McDonald's liabilities exceed its assets. The negative equity is largely due to the company's significant operational lease obligations, which are recorded as liabilities on the balance sheet. These leases are a common practice in the restaurant industry and are often treated as debt. However, this doesn't necessarily imply financial distress. McDonald's is a capital-rich company with strong cash flow. Despite the negative book value and debt-to-equity ratio, McDonald's has consistently demonstrated its ability to manage its debt effectively. All data is sourced from stockanalysis.com.

3.8 Earnings result

McDonald's reported its fourth-quarter 2024 earnings on February 10, 2025, with an EPS of $2.83, slightly below analysts estimates of $2.85. Revenue for the quarter came in at $6.39 billion, missing the estimated $6.45 billion. The company did not provide a guidance for the next quarter (Q1 2025).

3.9 Scoring

We give McDonald's a score of 4 out of 11 for Revenue Growth. While the growth is not explosive, which is typical for a more mature business, analysts still expect a revenue increase of 4.8% (CAGR over 3 years). This steady growth demonstrates McDonald's ability to maintain a positive revenue growth despite its large size and market maturity.

For EPS growth, analysts expect an increase of 7.6% (CAGR over 3 years), which is good, but not the minimum 10% EPS growth we like to see. For this reason, we assign McDonalds a score of 3 out of 7 for EPS growth.

We give McDonald's a score of 4 out of 5 for gross margin. With a gross margin of 56.8% (LTM), McDonald's significantly outperforms the industry average, typically ranging between 15% and 30%. While this margin is impressive, it’s important to note that it’s still lower than the margins seen in sectors like software or tech companies, which often reach much higher levels.

We give McDonald's a 4 out of 4 for its net profit margin of 31.7% (LTM), which is excellent and very high. This strong margin highlights how effectively the company turns revenue into profit.

McDonald's FCF yield of 3.1% (LTM) reflects a solid ability to generate cash relative to its market cap. While it’s not exceptionally high, this yield indicates strong cash generation, supporting dividends, share repurchases, and investments. Based on this, we give McDonald's a 2 out of 3 for its free cash flow yield.

McDonald's ROIC of 20.3% (LTM) clearly shows the company is using its capital efficiently, generating strong returns well above the cost of capital. For this reason, we give McDonald's a 3 out of 3 for ROIC

McDonald's has a negative debt-to-equity ratio of -13.68, primarily due to its significant operational lease obligations, which are treated as liabilities on the balance sheet. However, McDonald's has consistently demonstrated its ability to manage its debt effectively. For this reason, we give McDonald's a 2 out of 3 for debt-to-equity

McDonald's missed both revenue and EPS estimates for Q4 2024, slightly below analyst expectations. However, the company did not lower its guidance, which is why we give McDonald's a 1 out of 4 for earnings results. Had the guidance been revised downward, the score would have been just 0.

This result in a total financials & growth estimates score of 23/40 🟠

4. Risk Adjustments

Criteria:

- Chinese company: -10 points

- High cyclical or high-risk sectors: Banks, Biotech, Energy, or Commodities: -10 points

- Geopolitical risk: -5 points

- Small and Micro-cap stocks: -5 points / -10 points

- Altman-Z and Piotroski-F: -4 points / -2 points

McDonald's does not receive any deductions under our risk criteria. The company is not a Chinese company and does not operate in high-cyclical or high-risk sectors like Banks, Biotech, Energy, or Commodities. In fact, even during economic downturns, McDonald's performs well, as consumers tend to seek more affordable dining options. Additionally, we do not foresee any significant geopolitical risks affecting the company. McDonald's is also not a small or micro-cap company, which further avoids any point deductions. Lastly, McDonald's has an Altman-Z score of 4.96 (source: Koyfin), placing it in the Safe Zone with no deduction. The Piotroski-F score is stable at 5 (source: stockanalysis.com), also resulting in no point deduction.

As a result, McDonald's receives no point deductions in this category.

5. SWOT-analysis

In this section, we present a overview of the company's strengths, weaknesses, opportunities, and threats. This analysis will help you as an investor to get an overview of the company strategic position and to determine if McDonalds is a company you want to invest in.

Conclusion & Final Score

McDonald's is a strong company with a solid market position and a proven business model. Its franchise model, exceptional brand recognition and customer loyalty are key strengths, and the company continues to adapt effectively to changing consumer preferences. While it may not offer high growth potential in terms of revenue and growth in total adressable market (TAM), we believe McDonald's remains an attractive option for investors seeking stability and reliability even during economic downturns. With consistent performance and a dividend yield of 2.32%, McDonald's can be a solid choice for investors looking for a stable, more defensive stock in their portfolio. For these reasons Stefan has it in his portfolio.

After summing up the points, McDonald's receives a final score of 66/100 🟡

🔴 Less than 50 → Uninvestable

🟠 50 - 59 → Questionable

🟡 60 - 69 → Reasonable

🟢 70 - 79 → Quality

🔵 80 - 89 → High-Quality

🟣 90 or above → Exceptional

With this score, we classify McDonald's as REASONABLE 🟡

Only Stefan currently holds a position in McDonalds.

Thank you for reading! 🙏

We put a lot of love into creating this post for you. If you enjoyed it, feel free to click the ❤️ button so more people can discover it on Substack or hit the ↪️ share button to share it with friends, family and fellow investors!

Don’t hesitate to share your thoughts in the comments — we’d love to hear from you 💬

That’s it for today.

We’ll see you again in the next edition of our newsletter!

Until then, invest wisely.

Vincent & Stefan

The Future Investors

Disclaimer:

The information and opinions provided in this article are for informational and educational purposes only and should not be considered as investment advice or a recommendation to buy, sell, or hold any financial product, security, or asset. The Future Investors does not provide personalized investment advice and is not a licensed financial advisor. Always do your own research before making any investment decisions and consult with a qualified financial professional before making any investment decisions. Please consult the general disclaimer for more details.

Wow! Very thorough fundamental analysis. Appreciate the detailed insights!