2025 has been a strong year for the markets. Major indexes reached new record levels, even after a sharp correction in April due to trade tensions.

Looking at 2026, the question is simple: what comes next? After a year like this, expectations rise — but markets can always surprise. One thing we do know: the market can’t be predicted.

In this Insights article, we share our seven predictions for 2026 🔮. These are not facts or promises, just seven bold views on how the market could evolve over the year ahead.

Let’s dive in 👇

📈 #1: S&P 500 to $7,700, Nasdaq reaches $27,000

For 2026, we expect another positive year for the major U.S. indexes. Earnings growth will play a big role, especially for large technology companies. Big Tech still sets the tone for the market, and expectations going into next year look solid. On top of that, one or more interest rate cuts from the Fed could support markets further.

It’s often said that markets are expensive — and that’s true. For example, the S&P 500 is trading at a P/E ratio close to 31, which is high compared to history. But valuation alone doesn’t tell the full story. When we look at valuation together with expected earnings growth, the picture looks more balanced. The S&P 500’s PEG ratio is around 1.2, showing that valuations are high but not extreme when compared to expected growth.

Source: S&P 500 Valuation PEG Ratio, Yardeni Research

Because of this, we see room for the S&P 500 to move toward $7,700 (+12%) in 2026. For the Nasdaq, we see potential to reach $27,000 (+16%), supported by earnings growth and easier financial conditions.

📊 #2: Healthcare & Energy lead, Consumer sectors struggle

When it comes to sectors, Healthcare and Energy stand out in 2026. Healthcare is supported by aging populations, higher healthcare spending, and constant innovation. People keep using healthcare services in good times and bad, which helps revenues and earnings stay stable.

Energy benefits directly from the growth of AI. Data centers and digital infrastructure use huge amounts of electricity, pushing demand for power higher. This makes energy a key part of the AI story.

Technology will also have a good year, but the gap inside the sector becomes clear. Profitable tech companies with strong cash flows perform well. Unprofitable tech struggles as investors focus more on fundamentals.

Consumer sectors are under pressure. Higher prices leave consumers with less money to spend, which slows growth in these sectors.

🤖 #3: AI moves beyond tech, Nvidia reaches $6 trillion

AI remains the main theme in 2026, but it is no longer limited to the tech sector.

AI is now used across almost every industry. In Energy, it helps manage power grids and run data centers more efficiently. In Financials, AI improves fraud detection, risk management, and customer service. Across many sectors, companies use AI to work faster, lower costs, and improve productivity.

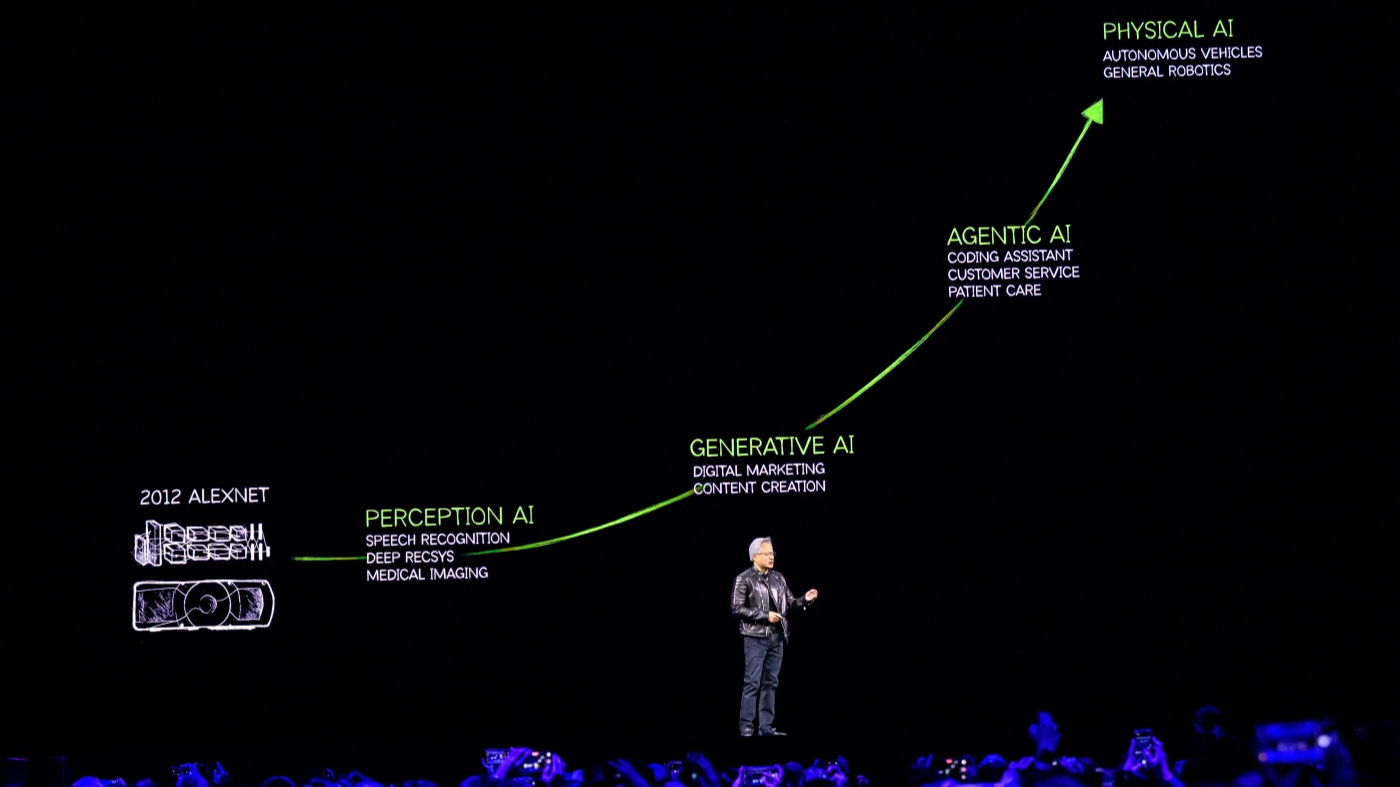

The difference in 2026 is that the results of years of AI investment become more visible. AI starts to deliver real value, not just future promises. A major breakthrough comes from AI agents. These tools handle tasks on their own and support both businesses and individuals in daily work. Adoption grows quickly as more people and organizations start using them.

As AI spreads across the economy, demand for computing power stays high. This puts Nvidia in a strong position, and we expect the company to reach a market cap of $6 trillion in 2026.

Source: Nvidia Investor Relations, Nvidia GTC 2024 keynote

💵 #4: Rates come down, volatility stays

In 2026, interest rates move lower, but not in a straight line. The Fed starts the year with one rate cut as inflation continues to ease and economic growth slows slightly. Later in the year, a second rate cut follows as inflation stays under control and the Fed looks to support the economy. By the end of 2026, we expect interest rates to be at 3.00%–3.25%.

But inflation doesn’t fully go away. Prices for services and wages stay higher, which keeps the Fed cautious and limits how fast rates can fall. Rate cuts support markets, but the era of “free money” does not return.

Because of this, markets stay volatile in 2026. Ups and downs are part of the picture, and markets won’t move in a straight line. Good returns are still possible, but investors need to focus on quality companies with strong fundamentals, as not all stocks move higher at the same time.

🔥 Upgrade now to paid and get 30% off!

Get instant access to our Portfolios, our monthly Best Buys, all Deep Dives — plus 350+ premium articles to explore! Cancel anytime ✅

🪙 #5: Bitcoin to $155,000, stablecoins drive adoption

Bitcoin starts 2026 relatively flat, with no clear direction. Later in the year, sentiment improves as financial conditions become easier. After the second rate cut, Bitcoin gains momentum and moves toward a peak of $155,000.

Ethereum also performs well. More activity on the network and wider use support its role in the crypto market. Many altcoins struggle. Only a small group with clear use cases and active communities performs well, while most altcoins fall behind.

Another clear trend is the growth of stablecoins. They are increasingly used for payments, transfers, and everyday transactions by people and businesses. This makes crypto more practical and easier to use across borders.

🚀 #6: A busy IPO year, SpaceX at $1.5 trillion

The IPO market picks up again in 2026. More companies decide to go public, with a strong focus on tech. Early in the year, Anthropic is the first big name to list in Q1. Later in the year, Canva and Databricks follow as market conditions improve and interest in new listings grows.

The biggest moment comes in September, when SpaceX goes public. The listing attracts global attention and becomes the largest IPO ever, with a market cap of $1.5 trillion.

Not every AI company goes public in 2026. OpenAI sees rising competition from players like Gemini, Claude, and Perplexity and decides to wait longer. The company shifts its IPO plans to 2027.

🤝 #7: More acquisitions, Microsoft buys UiPath

In 2026, acquisitions play a bigger role across Healthcare, Energy, and Technology.

In Healthcare, Eli Lilly acquires Abivax, a French biotech, to strengthen its pipeline and expand its position in immunology and inflammation.

In Tech, Microsoft acquires UiPath to bring AI-driven automation deeper into its enterprise ecosystem. By combining AI with workflow automation, Microsoft helps companies work more efficiently, lower costs, and automate everyday tasks across Office, Azure, and enterprise software.

Source: UiPath Presentation, strategical collaboration Microsoft

Deal activity also increases in AI infrastructure. Large tech companies move to secure access to compute and power, leading to more deals between Neo Cloud players and big tech.

These seven points reflect how we currently see 2026. They are predictions, not certainties. Markets change, new information appears, and reality often takes a different path.

The year ahead will show which themes play out and which ones surprise us.

And that’s what makes investing both challenging and rewarding.

Thank you for reading! 🙏

We put a lot of love into creating this post for you. If you enjoyed it, feel free to click the ❤️ button so more people can discover it on Substack or hit the ↪️ share button to share it with friends, family and fellow investors!

Don’t hesitate to share your thoughts in the comments — we’d love to hear from you 💬

That’s it for today.

We’ll see you again in the next edition of our newsletter!

Until then, invest wisely.

Vincent & Stefan

The Future Investors

Disclaimer:

The information and opinions provided in this article are for informational and educational purposes only and should not be considered as investment advice or a recommendation to buy, sell, or hold any financial product, security, or asset. The Future Investors does not provide personalized investment advice and is not a licensed financial advisor. Always do your own research before making any investment decisions and consult with a qualified financial professional before making any investment decisions. Please consult the general disclaimer for more details.

What's your view on the dollar ? I assume it remains weak against the euro and therefore gold and gold miners remain interesting to me (the latter, the miners). Ben