📰 Why First Solar Stock Is Suddenly on Fire

A dramatic policy shift, fresh analyst upgrades, and strong U.S. incentives have triggered a 50% rally — just two weeks after a disappointing earnings report.

First Solar FSLR 0.00%↑ is on a strong run. The stock rose 11% on Monday, climbed another 20% today, and is now almost 50% over the past few days, a surprising rebound that few expected.

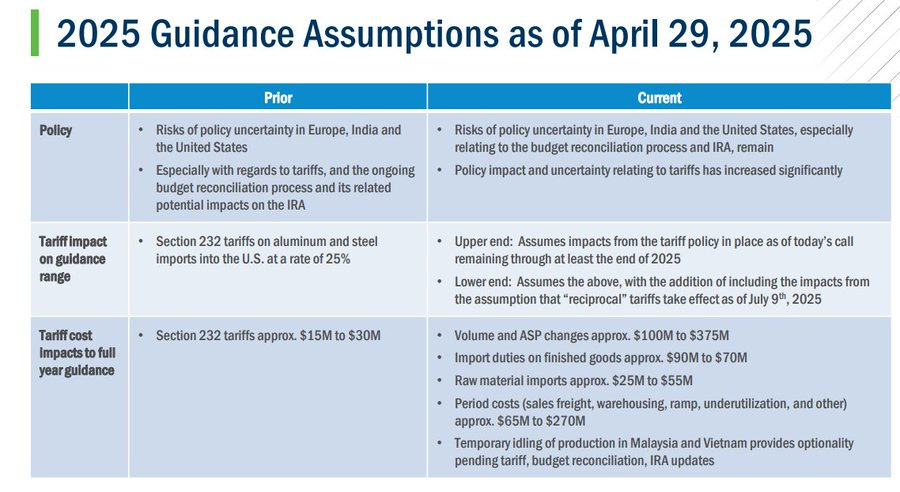

What makes the rise even more impressive is the timing. Just two weeks ago, First Solar let investors down with a weak earnings report and cut its full-year outlook by billions. Confidence was low, and the stock was falling. But that changed almost overnight, thanks to a key policy shift, followed by analyst upgrades, and a growing awareness of the company’s long-term strengths.

From pressure to potential

The main catalyst was a surprise decision from Washington. The U.S. had been preparing to raise import tariffs on solar panels from 10% to 46%, a move that would have made much of First Solar’s planned 2025 production from Southeast Asia unprofitable. Around 14 gigawatts of its expected output could have been impacted, a potential multi-billion dollar headwind.

Source: First Solar Investor Presentation Q1 2025

But instead of going ahead with the tariff increase, the government decided to delay it for 90 days. The current 10% tariff will stay in place while talks continue. This gave First Solar some breathing room, helped protect its profit margins, and quickly improved its short-term outlook.

At the same time, First Solar is in a very strong market position. Most Chinese solar panel makers are still blocked from selling in the U.S. because of high tariffs — some even above 3,000% — on crystalline silicon panels. That means First Solar faces less competition and is in a great spot to meet the rising demand for solar panels in the U.S.

And there’s another advantage. Thanks to the Inflation Reduction Act, First Solar gets a tax credit of $0.17 for every watt of solar panel it produces in the U.S. This makes American-made panels more profitable. As First Solar builds more factories in the U.S., these government incentives will continue to support its profits. It’s a rare case where a company is protected from foreign rivals and also rewarded for growing at home.

Confidence returns

That change has already caught attention. On Tuesday, Wolfe Research upgraded First Solar to ‘Outperform’ and raised its price target to $221. The firm pointed to strong support from government policies, agreement across political parties on clean energy, and First Solar’s advantage as tensions with China continue to rise. Even a new proposal to shorten the 45X tax credit period was seen as a positive step, because it could reduce political uncertainty ahead of the next elections.

More investors are starting to pay attention. After being valued as a risky stock, First Solar is now being seen as a stronger and more stable company.

There are now a few key dates that investors are watching, moments that could influence the next stage of this rally:

June – A U.S. vote on whether to make tariffs on Chinese solar panels permanent.

July 9 – The end of the 90-day pause on the tariff increase.

Late July / Early August – Q2 results: The first look at how pricing, profit margins, and tax credits are affecting the company’s performance.

The sun is shining

Two weeks ago, things weren’t looking great for First Solar. It seemed like the company was heading for a difficult year. But after one important policy change, new government support, and the company’s strong competitive position, the story completely turned around.

We’ve named First Solar one of our Best Bulls of the Month several times in recent months. And now, with the stock rising nearly 50% in just a few days, that confidence is clearly paying off.

Momentum is back. The biggest risks have faded. And the company is now in a stronger position than ever to benefit from smart policies and solid performance. The sun is shining on First Solar — and more investor are finally seeing it.

Source: First Solar Investor Presentation Q1 2025, Investing.com

Thank you for reading! 🙏

We put a lot of love into creating this post for you. If you enjoyed it, feel free to click the ❤️ button so more people can discover it on Substack.

Don’t hesitate to share your thoughts in the comments — we’d love to hear from you 💬

Disclaimer:

The information and opinions provided in this article are for informational and educational purposes only and should not be considered as investment advice or a recommendation to buy, sell, or hold any financial product, security, or asset. The Future Investors does not provide personalized investment advice and is not a licensed financial advisor. Always do your own research before making any investment decisions and consult with a qualified financial professional before making any investment decisions. Please consult the general disclaimer for more details.