🎓 Why It's Impossible to Perfectly Time the Market

Missing the market’s best days can crush your returns. Here’s the strategy we use instead.

Yesterday was a big day for the market

Yesterday, the stock market had one of the biggest up days since World War II. The S&P 500 jumped 9.5% in a single day, making it the 3th biggest daily gain in almost 80 years!

This huge rise came after a surprise announcement from Donald Trump that there will be a 90-day pause on new import tariffs so that the U.S. can negotiate with other countries. For now, most tariffs stay at 10%, but for China, they’re going up to 125%.

A few days ago, it was already posted on X (formerly Twitter) that Trump might pause the tariffs. The markets reacted directly, but the White House quickly denied it, and the markets dropped again. Investors were left confused, not knowing what to believe. But now it’s official.

The market was falling fast

Since the new tariffs started on April 2, the market had been falling fast. The S&P 500 dropped more than 12% in just 4 days. The 12th biggest decline since 1950. People were nervous. Many were asking:

“Should I buy now?”

“Is this the bottom?”

“Should I wait?”

“Should I sell and get back in later?”

The problem is: nobody knows when the market will hit the bottom. And if you wait too long, or get out and try to jump back in, you miss the best days.

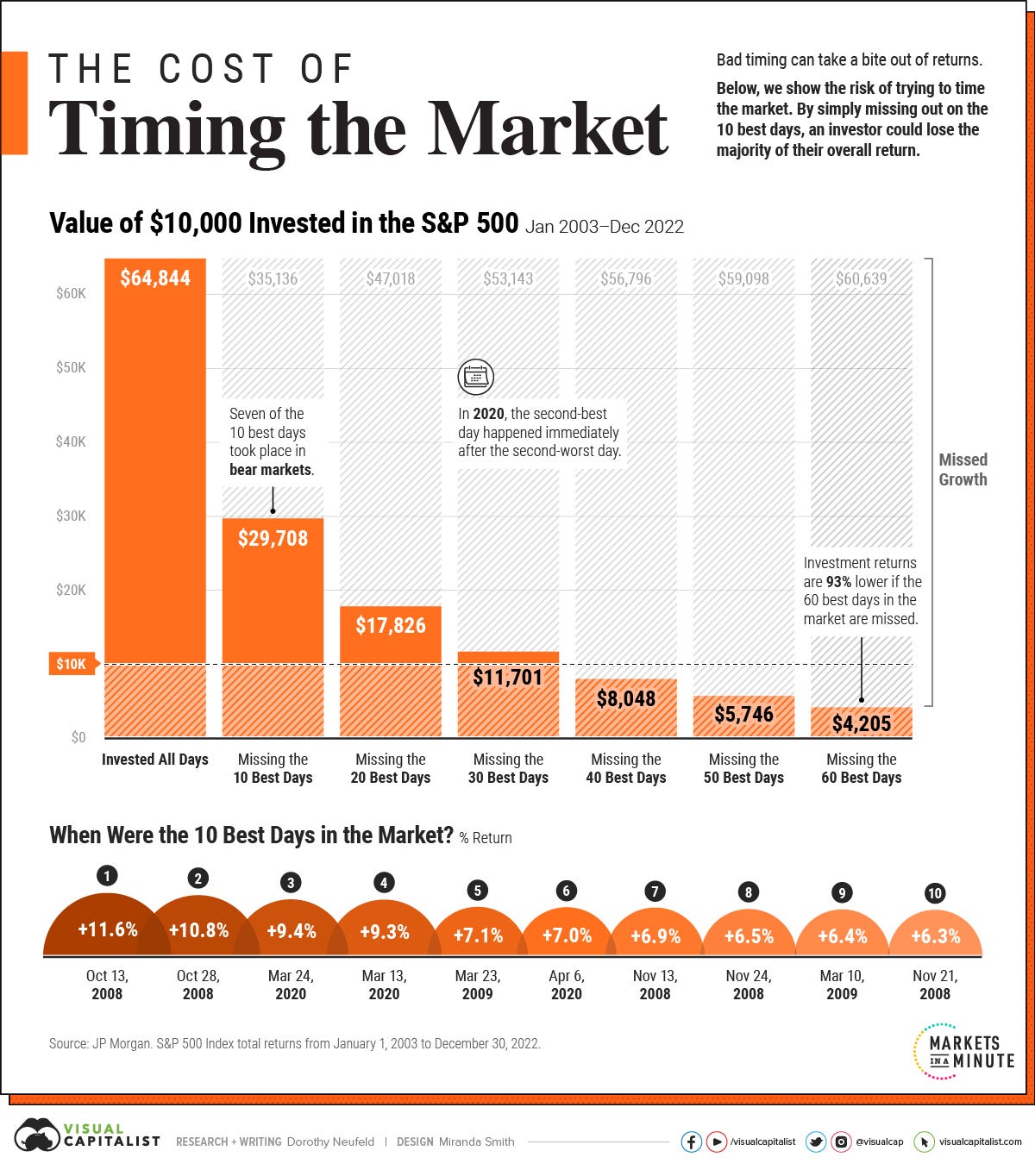

And those best days? They often come right after the worst ones as you can see in the chart below:

Source: FMP Wealth Advisers

The costs of timing the market

Let’s say you had invested $10,000 in the S&P 500 between January 2003 and December 2022, and you just left it alone. You would have $64,844.

But if you missed just the 10 best days in that whole 20-year period, you would have only $29,708. That’s less than half.

And get this, 7 of those 10 best days happened during bear markets, when things looked really bad.

If you had missed the 40 best days, your return would actually be negative.

This shows how dangerous it can be to jump in and out of the market. Timing it wrong will costs you money.

There’s a reason investors say: “Time in the market beats timing the market.”

Source: Visual Capitalist

Our strategy instead of timing

Since timing the market is so hard (basically impossible), we follow a different plan — one that doesn’t rely on timing the market.

Here’s what we do: