Welcome to the 6th edition of Unpacked, our monthly series where we take a deep dive into a company. This time, we’re taking a closer look at Axon — the company behind the TASER, body cameras, and cloud software that’s redefining public safety.

We break down its story, business model, and highlight the latest developments.

Additionally, we do a detailed fundamental analysis, diving into the company’s management, market, financials, and growth estimates. We score each area separately, leading to a final score between 0 and 100. This score reflects how fundamentally attractive we believe the company is as an investment, ranging from:

🔴 Below 50 → Uninvestable

🟠 50 - 59 → Questionable

🟡 60 - 69 → Reasonable

🟢 70 - 79 → Quality

🔵 80 - 89 → High-Quality

🟣 90 or above → Exceptional

The goal? To give you a full deep dive into this company, as a complement to your own research, so you can decide if it’s the right investment for you.

In case you missed it, here you can read the previous editions of Unpacked:

Now let’s unpack the fundamentals of Axon — and see how we score it!

History and Business Model

Axon Enterprise was founded in 1993 by Rick Smith, originally under the name TASER International, with the goal of protecting life by building safer alternatives to firearms. After two of his friends were killed in a shooting, Smith became convinced that technology could help reduce violence. The first step was the TASER, a non-lethal weapon designed to stop threats without having to use bullets. Today, Axon defines its mission more broadly: “to protect life, capture truth, and accelerate justice.”

Through the 1990s and 2000s, TASER devices spread across police departments in the U.S. and abroad. But Axon realized that protecting life also required trust and transparency. In response, the company expanded into body-worn cameras, giving officers and communities a new level of accountability.

In 2001, the company went public on the Nasdaq under the ticker TASR, providing capital to scale internationally. In 2017, TASER International rebranded as Axon Enterprise, reflecting its broader mission to build a connected ecosystem of safety technology. The ticker changed to AXON, marking its shift from hardware maker to full public safety platform.

Today, Axon operates across three areas: TASER devices, body cameras, and the Axon Cloud, which securely stores and manages digital evidence. Together, they form an integrated system designed to protect life, increase accountability, and accelerate justice.

Business Model explained

Axon makes money through a mix of hardware and recurring software subscriptions. What began as a product company has evolved into a software-driven platform with SaaS at its core:

Devices: TASERs and body cameras, often sold through multi-year contracts with upgrades included.

Software: The Axon Cloud stores and manages video and evidence on a subscription basis, creating sticky, high-margin revenue.

Bundles: With Officer Safety Plans, agencies pay predictable annual fees for hardware, software, and support combined.

This gives Axon the best of both worlds: steady hardware demand plus scalable, recurring revenue. Once an agency adopts Axon, switching becomes difficult — evidence, workflows, and training are all tied into the platform.

By combining devices, cloud, and services into one ecosystem, Axon has built a business that grows with each contract and becomes stronger as more users and evidence flow into its network.

🎥 Watch the video to discover how the Axon Ecosystem helps protect more lives in more places 👇

Revenue Breakdown

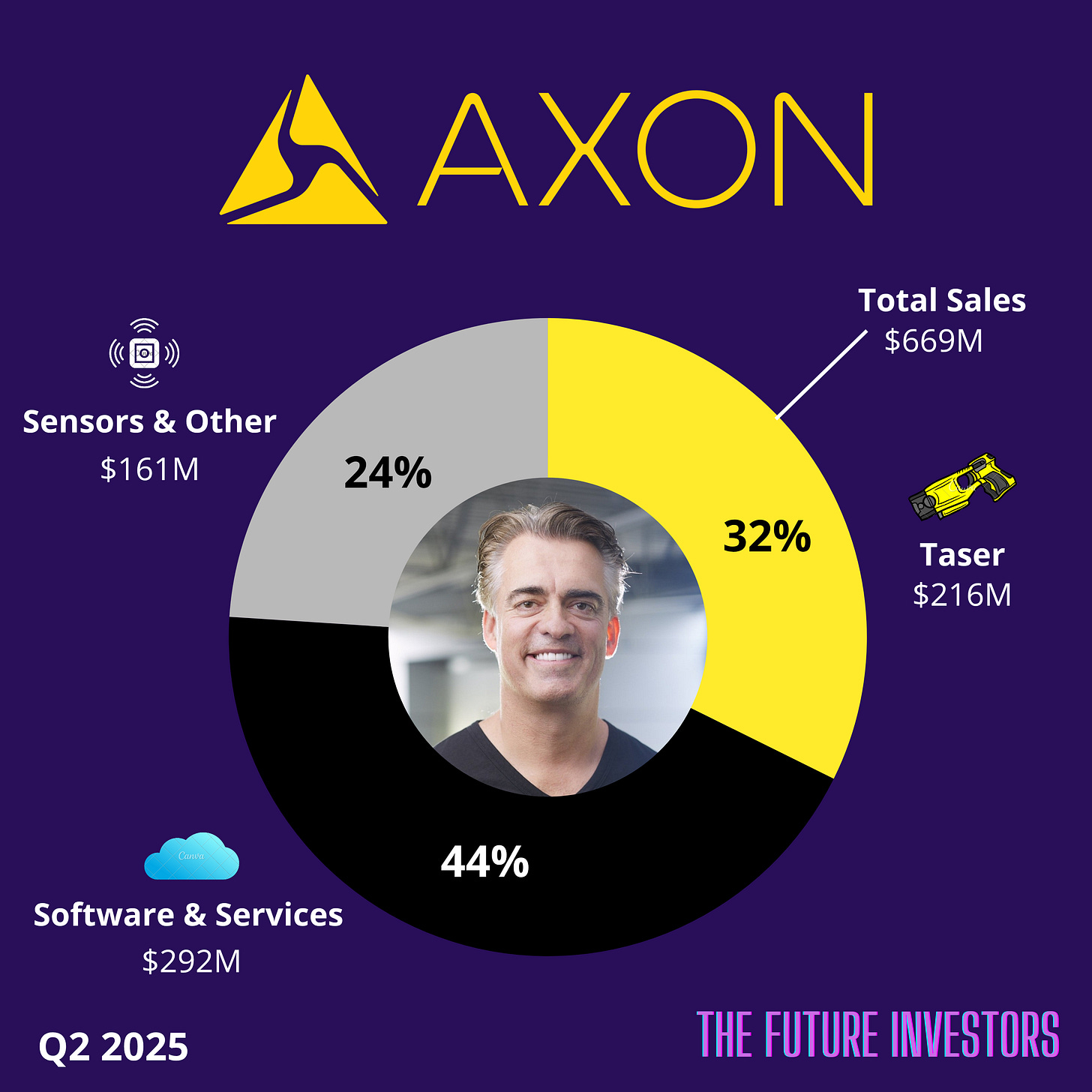

In the second quarter of 2025, Axon reported $669 million in revenue, up 33% from last year. Most growth came from software, with devices helping to widen the customer base and tie more users into subscriptions.

Software & Services ($292 million, 44%)

Axon’s cloud platform is at the heart of its growth. It helps agencies manage digital evidence, run operations in real time, and even train officers through VR and AI tools. Because customers pay through subscriptions, revenue is both recurring and high-margin. And as agencies add more users and features, those revenues naturally scale up.

Connected Devices ($377 million, 56%)

This segment includes Axon’s hardware, which is key to getting agencies into the ecosystem. It has two main parts:

TASER ($216 million, 32%)

TASERs remain a cornerstone of the business, with steady demand from upgrades and refresh cycles — especially the new TASER 10. Beyond device sales, TASERs often serve as the first step toward wider Axon bundles and cloud subscriptions.Sensors & Platform Solutions ($161 million, 24%)

This category covers body-worn and in-car cameras, VR training gear, fixed cameras, drones/counter-drone tools, and interview-room systems. These products connect directly with the Axon Cloud, making agencies more reliant on its platform.

Recent Developments

Axon is steadily turning into a full public safety platform. Here are the most important developments from the past year:

AI Era Plan

Launched in 2024, the AI Era Plan bundles together Draft One (AI report writing), Policy Chat, real-time translation, and auto-transcription. These tools cut down paperwork and boost officer productivity, with Draft One quickly becoming one of Axon’s fastest-selling products.Body 4 and ALPR cameras

The Body 4 bodycam now offers sharper video, livestreaming, and a built-in voice assistant. Axon also added Outpost and Lightpost ALPR cameras for real-time vehicle recognition.Partnership with Ring

In 2025, Axon announced a partnership with Ring. Residents can choose to share home security footage with police, strengthening collaboration between communities and agencies.Drones and counter-drone

Through a partnership with Skydio and the acquisition of Dedrone, Axon is expanding into drone programs and counter-drone defense. Both integrate with the Axon Cloud.Brief One for Justice

Set to launch in October 2025, this AI-powered solution is designed for prosecutors and public defenders. It streamlines the review of massive volumes of digital evidence, easing caseload pressures and speeding up court workflows.Prepared acquisition

Prepared, an AI-powered emergency response startup, has been acquired. Its technology helps 911 centers transcribe and translate calls and stream live video. The deal is expected to close in early Q4 2025.

🔥 Upgrade now to paid and get 30% off!

Unlock instant access to this Axon deep dive, all past deep dives, our full portfolios, every transaction — plus 350+ premium articles ✨

Upgrade today for just $329/year

That’s only $0.90 a day and save $691🔥

Full access, cancel anytime ✅

Fundamental Analysis

Now it’s time for the fundamental analysis of Axon!

In this section, we evaluate three key areas: management, market, and financials & growth estimates. Each area contains multiple elements and each element is scored individually, leading to a final score between 0 and 100.

Final Scoring

This score reflects how fundamentally attractive we believe Axon is as an investment, ranging from:

🔴 Below 50 → Uninvestable

🟠 50 - 59 → Questionable

🟡 60 - 69 → Reasonable

🟢 70 - 79 → Quality

🔵 80 - 89 → High-Quality

🟣 90 or above → Exceptional

Unlock our scoring framework and full fundamental analysis below, and see how we score Axon on a scale from 0 to 100 — exclusively available to our paid members! 🚀