Welcome to the 7th edition of Unpacked, our monthly series where we take a deep dive into a company. This time, we’re taking a closer look at IREN Limited — a fast-growing Australian company building renewable-powered data centers for the AI era.

We break down its story, business model, and highlight the latest developments.

Additionally, we do a detailed fundamental analysis, diving into the company’s management, market, financials, and growth estimates. We score each area separately, leading to a final score between 0 and 100. This score reflects how fundamentally attractive we believe the company is as an investment, ranging from:

🔴 Below 50 → Uninvestable

🟠 50 - 59 → Questionable

🟡 60 - 69 → Reasonable

🟢 70 - 79 → Quality

🔵 80 - 89 → High-Quality

🟣 90 or above → Exceptional

The goal? To give you a full deep dive into this company, as a complement to your own research, so you can decide if it’s the right investment for you.

In case you missed it, here you can read the previous editions of Unpacked:

Now let’s unpack the fundamentals of IREN Limited — and see how we score it!

History and Business Model

IREN Limited, formerly Iris Energy, was founded in 2018 in Sydney by brothers Daniel and Will Roberts. Their idea was simple: use renewable energy to power the future of computing. They started with Bitcoin mining, turning clean, low-cost electricity into a more sustainable way to run energy-hungry data centers.

The company built its first sites near hydropower plants in British Columbia, Canada, where renewable power was cheap and reliable. That focus on clean energy gave IREN a strong advantage — both in cost and in sustainability — in an industry often criticized for its carbon footprint.

In the early years, IREN focused fully on Bitcoin mining. It was a way to generate cash and learn how to run large-scale computing operations efficiently. The business grew quickly, and in 2021 the company went public on the Nasdaq (ticker: IREN) to fund further expansion across North America.

As the AI boom began, IREN saw a much bigger opportunity. The same infrastructure built for mining could also power AI and high-performance computing (HPC) — and global demand for computing power was growing fast. In 2023, IREN began shifting from a pure Bitcoin miner to a renewable-powered infrastructure company, building new capacity to host large-scale GPU systems for AI clients.

In 2024 and 2025, IREN continued that shift, expanding in Texas, Canada, and Asia-Pacific. The company signed long-term partnerships with GPU providers and hyperscalers and started building its Next-Gen AI Compute Platform, designed to host NVIDIA GPUs at scale.

Today, IREN is in the middle of its transition from a Bitcoin miner to a renewable-powered data center company — building the infrastructure to power the rise of AI, still driven by the same clean-energy vision it started with.

The video below gives a good overview of IREN’s journey so far 🎥👇

Business Model explained

IREN uses renewable energy to power high-performance computing. It builds and operates large, clean-powered data centers for two key markets:

⛏️ Bitcoin Mining

IREN mines Bitcoin with its own hardware and earns revenue directly from the Bitcoin it produces. This part of the business provides steady cash flow and helps fund new projects.

🤖 AI and HPC Hosting

IREN also rents out computing power to companies running AI and cloud workloads — from training models to everyday processing. These contracts usually run for several years, creating predictable, recurring revenue.

What makes IREN different is that it builds and owns everything itself. It develops sites near renewable power, connects them to the grid, and operates the data centers directly. That keeps costs down and energy use low — a clear advantage in both Bitcoin and AI computing.

IREN’s model is changing quickly:

From volatile to recurring: As AI hosting grows, more of its revenue comes from long-term contracts instead of Bitcoin price swings.

From miner to infrastructure builder: IREN is turning into a clean-energy platform for the AI era, using its renewable roots to attract large customers who need sustainable compute power.

From hardware to capability: Its new high-density data centers can host advanced GPUs and AI systems that many traditional facilities can’t support.

Together, these shifts show how IREN is moving beyond Bitcoin — becoming a renewable-powered compute company building the infrastructure behind the AI revolution, while staying true to its clean-energy roots.

As CEO Daniel Roberts said earlier this year:

“We started with Bitcoin, but our mission was always bigger — to build the clean compute backbone for the next generation of technology.”

Revenue Breakdown

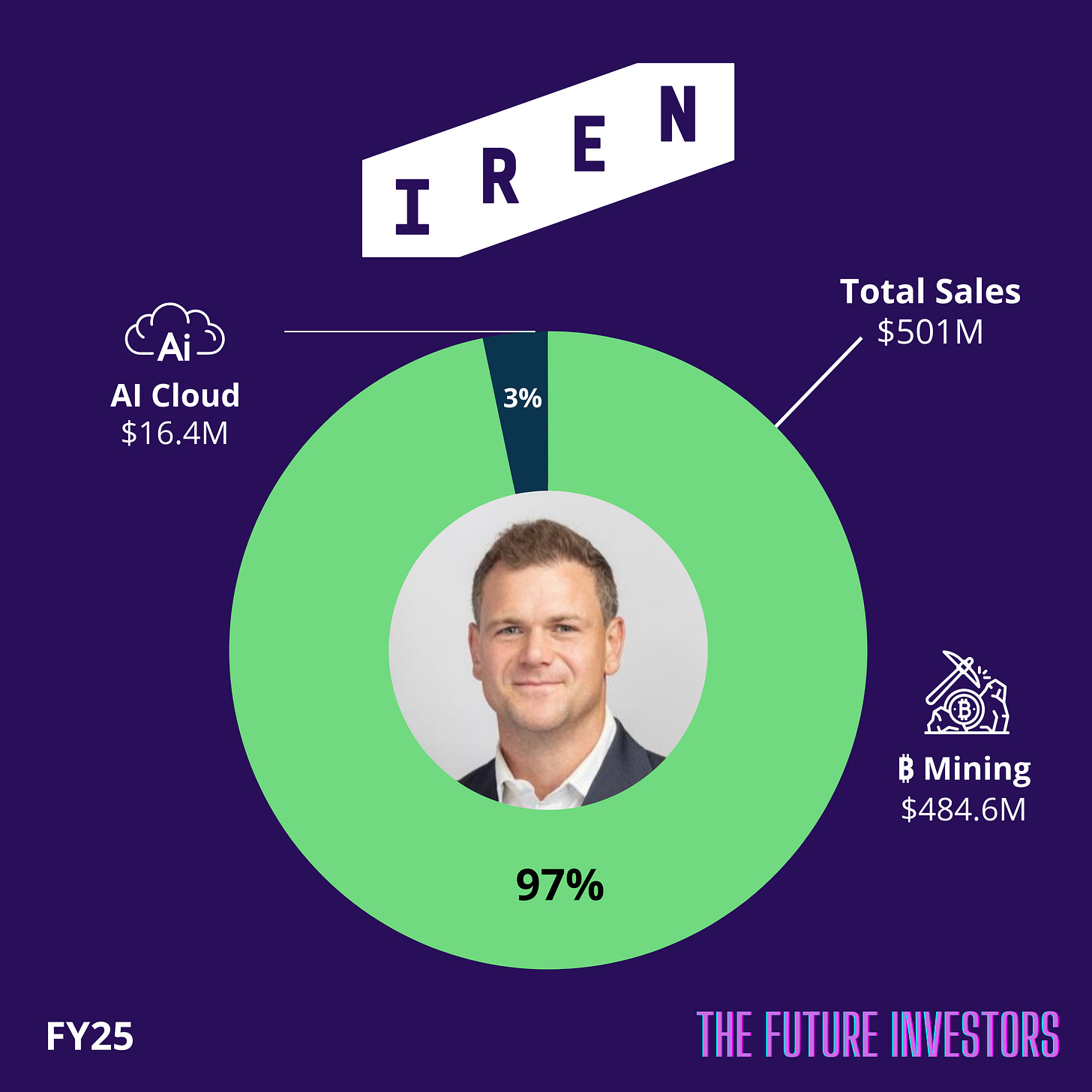

On August 28, 2025, IREN reported its full-year FY25 results. Total revenue rose to $501 million, up 168% from FY24 — driven by strong Bitcoin mining output and early growth in AI services.

⛏️ Bitcoin Mining – $484.6 million (97%)

Bitcoin mining still makes up nearly all of IREN’s revenue. With low-cost renewable power and efficient operations, the company stays profitable even when Bitcoin prices move. This steady cash flow funds IREN’s expansion into AI infrastructure.

🤖 AI Cloud Services – $16.4 million (3%)

This new segment is small but growing fast. It includes early contracts to host GPU compute capacity for enterprise and hyperscale clients. These multi-year agreements bring predictable, recurring revenue and are expected to scale further in FY26 as new data centers come online.

Recent Developments

IREN is steadily transforming from a Bitcoin miner into a renewable-powered data center company building the backbone for AI computing. Here are the recent key developments:

1️⃣ AI Cloud Expansion

This year, IREN rapidly scaled its AI Cloud business — growing from 1,900 to over 10,000 GPUs across sites in Canada and Texas. The company now expects to exceed 23,000 GPUs under contract and reach more than $500 million in annualized AI Cloud revenue by early 2026. Of the 23,000 GPUs targeted for AI Cloud, 11,000 are already under contract ($225 million ARR as of October 2025).

2️⃣ Multi-Year AI Contracts

This month, IREN signed several long-term hosting deals with enterprise and hyperscale clients. These agreements bring steady, recurring revenue and mark IREN’s shift toward a full GPU-as-a-Service model.

3️⃣ $1 Billion Funding Round

To finance its expansion, IREN raised $1 billion through convertible notes this month. The funding accelerates its new AI infrastructure buildout while limiting shareholder dilution.

4️⃣ Data Center Growth

IREN now has nearly 3 GW of grid connections secured across its main sites:

Childress, Texas (750 MW): first 50 MW data center on track for Q4 2025, second phase underway.

Sweetwater, Texas (2 GW): large AI hub set for April 2026.

Prince George, Canada (160 MW): transitioning from mining to AI, adding liquid-cooled NVIDIA Blackwell GPUs.

5️⃣ NVIDIA Partnership

IREN became an NVIDIA Preferred Partner, gaining early access to the new Blackwell GPUs. The company also expanded relationships with major cloud and enterprise clients focused on sustainable, high-performance compute.

6️⃣ New CFO

Last month, Anthony Lewis joined as Chief Financial Officer. With experience in infrastructure finance and GPU leasing, he’s helping IREN scale responsibly as it grows its AI operations.

7️⃣ Efficiency & Cash Flow

IREN’s mining operations remain highly efficient — with power costs around 3.5 ¢/kWh and strong cash generation. These profits help fund its AI expansion while keeping the balance sheet solid.

🔥 Upgrade now to paid and get 30% off!

Unlock instant access to this IREN deep dive, all past deep dives, our full portfolios, the monthly Best Buys — plus 350+ premium articles ✨

Upgrade today for just $329/year

That’s only $0.90 a day and save $691🔥

Full access, cancel anytime ✅

Fundamental Analysis

Now it’s time for the fundamental analysis of IREN.

In this section, we evaluate three key areas: management, market, and financials & growth estimates. Each area contains multiple elements and each element is scored individually, leading to a final score between 0 and 100.

Final Scoring

This score reflects how fundamentally attractive we believe IREN is as an investment, ranging from:

🔴 Below 50 → Uninvestable

🟠 50 - 59 → Questionable

🟡 60 - 69 → Reasonable

🟢 70 - 79 → Quality

🔵 80 - 89 → High-Quality

🟣 90 or above → Exceptional

Unlock our scoring framework and full fundamental analysis below, and see how we score IREN on a scale from 0 to 100 — exclusively available to our paid members! ✨