Welcome to the 9th edition of Unpacked, our monthly series where we take a deep dive into a company. This time, we’re taking a closer look at Broadcom — a global semiconductor and infrastructure software powerhouse, playing a critical role in AI, data centers, networking, and enterprise cloud.

We break down its story, business model, and highlight the latest developments.

Additionally, we do a detailed fundamental analysis, diving into the company’s management, market, financials, and growth estimates. We score each area separately, leading to a final score between 0 and 100. This score reflects how fundamentally attractive we believe the company is as an investment, ranging from:

🔴 Below 50 → Uninvestable

🟠 50 - 59 → Questionable

🟡 60 - 69 → Reasonable

🟢 70 - 79 → Quality

🔵 80 - 89 → High-Quality

🟣 90 or above → Exceptional

The goal? To give you a full deep dive into this company, as a complement to your own research, so you can decide if it’s the right investment for you.

In case you missed it, here you can read the previous editions of Unpacked:

Now let’s unpack the fundamentals of Broadcom — and see how we score it!

History and Business Model

Source: Broadcom’s Heritage of Innovation (Broadcom Investor Relations)

Broadcom’s story goes way back, much further than most tech giants. It started in 1961 as a semiconductor division inside Hewlett-Packard, called HP Associates. Decades later, in 1999, it became part of Agilent Technologies after a spin-off from HP.

A big shift came in 2005, when private equity firms KKR and Silver Lake bought the semiconductor unit and renamed it Avago Technologies. Avago went public in 2009 on the Nasdaq under ticker $AVGO.

Avago grew quickly through acquisitions. The biggest moment came in 2016, when it completed the $37 billion acquisition of Broadcom. After the deal, the company took the Broadcom name (the stronger global brand) and decided to keep the $AVGO ticker from the Avago days.

Later, Broadcom also moved into infrastructure software. The largest step came with the acquisition of VMware, a leader in virtualization and cloud infrastructure software, announced in 2022 and completed in November 2023, valued at around $69 billion.

Today, Broadcom’s mission is clear:

“To deliver the best semiconductor and infrastructure software solutions to enable our customers to build and grow their businesses.”

The video below gives a clear overview of what Broadcom exactly does 🎥👇

Business Model explained

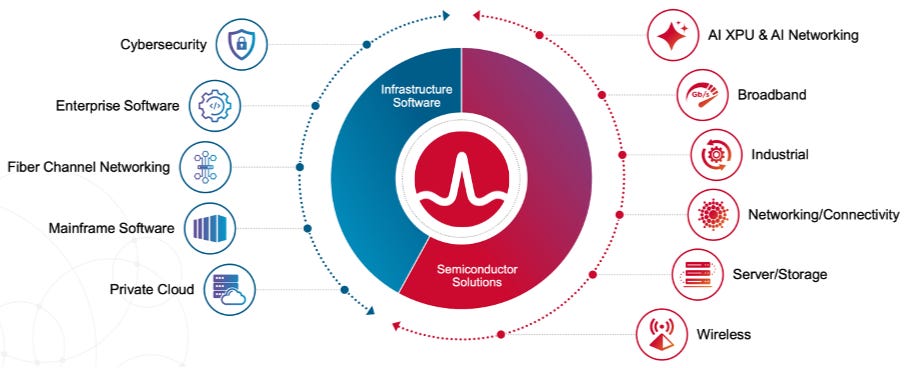

Broadcom is not just a chip company. Today, it has two main business segments: Semiconductor Solutions and Infrastructure Software.

Source: Broadcom ecosystem (Broadcom Investor Relations)

🧠 1. Semiconductor Solutions

This is Broadcom’s largest business. It sells chips used in data centers, networks, broadband, smartphones, and storage systems. Many of these chips are essential for moving data fast and keeping networks running smoothly. Broadcom also builds custom chips for some of its biggest customers. Once these chips are designed into a system, they’re not easy to swap out, which helps Broadcom keep long-term demand.

🖥️ 2. Infrastructure Software

Broadcom also sells software that large companies use every day to keep their IT running. This includes software for mainframes, cybersecurity, and cloud infrastructure. The biggest part today is VMware, which helps companies run their servers and build private clouds. This business brings in more recurring revenue, because customers usually stay for years and pay ongoing fees.

⚖️ Why this mix matters

Broadcom’s strength is that it combines scale in hardware with sticky software revenue. Semiconductors benefit from AI and data center growth. Software brings stability and recurring cash flows. Together, this makes Broadcom one of the most important companies in global technology.

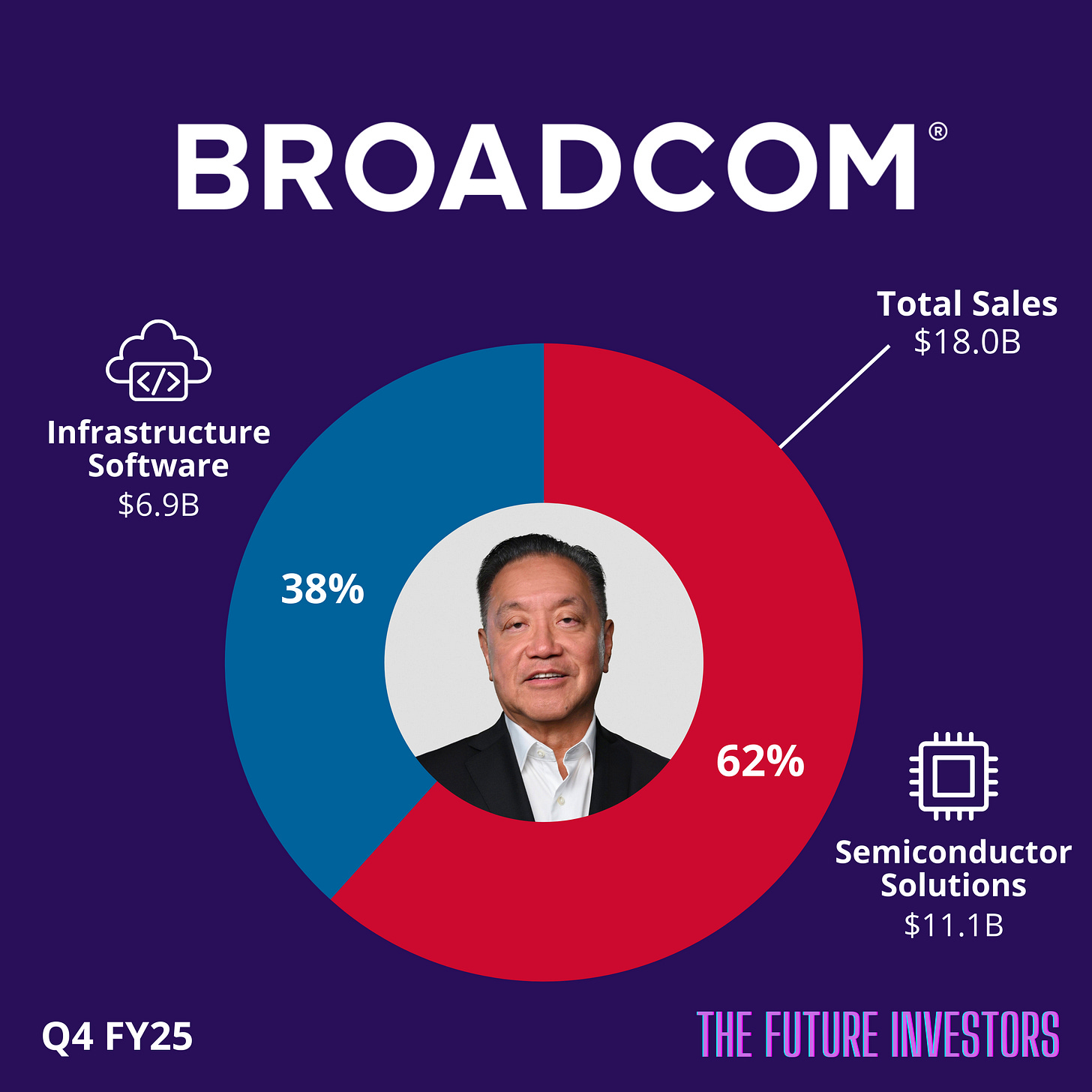

Revenue Breakdown

On December 11, 2025, Broadcom reported its Q4 FY25 results. Revenue reached $18.0 billion, up +28% YoY.

🧠 Semiconductor Solutions – $11.1B (62%)

Broadcom’s largest segment, driven by networking, connectivity, broadband, and AI-related demand.

🖥️ Infrastructure Software – $6.9B (38%)

Recurring software revenue, led by VMware and enterprise infrastructure products.

Recent Developments

Broadcom has had a strong year. It doubled down on AI infrastructure, expanded VMware, and launched new products across networking and wireless. Here are the biggest developments since late 2024:

1️⃣ Joining the trillion-dollar club

In December 2024, Broadcom became a $1 trillion market cap company for the first time. Today, it is worth over $1.5 trillion, supported by strong AI demand and a growing software business.

2️⃣ Jericho4: a new networking chip for AI data centers

In mid-2025, Broadcom launched Jericho4, a networking chip built for AI data centers. It helps move huge amounts of data faster, even across longer distances between data centers.

3️⃣ Scaling custom AI chips for hyperscalers

Over the past year, demand has grown for Broadcom’s custom AI chips (XPUs) from hyperscale customers. Instead of selling one “standard” accelerator, Broadcom helps large platforms build chips tailored to their own workloads.

4️⃣ A massive OpenAI partnership for custom AI accelerators

In October 2025, Broadcom and OpenAI announced a strategic collaboration to build up to 10 gigawatts of custom AI accelerator systems. OpenAI will design the chips, while Broadcom will develop and deploy them. The rollout is expected to start in H2 2026 and run through 2029.

5️⃣ The industry’s first Wi-Fi 8 silicon ecosystem

Also in October 2025, Broadcom introduced its Wi-Fi 8 silicon solutions, bringing the next wave of faster and more stable wireless connectivity for future devices and networks.

6️⃣ VMware Cloud Foundation becomes more “open”

In November 2025, Broadcom expanded the VMware Cloud Foundation (VCF) ecosystem with a more open partner approach. This makes it easier for enterprises to build modern private cloud environments with more certified hardware and infrastructure partners.

🔥 Upgrade now to paid and get 25% off!

Unlock full access to this Broadcom Deep Dive, all other Deep Dives, our Top 10 Picks 2026, our Portfolios, our monthly Best Buys — plus 375+ premium articles. Instant access ✅

Fundamental Analysis

Now it’s time for the fundamental analysis of Broadcom.

In this section, we evaluate three key areas: management, market, and financials & growth estimates. Each area contains multiple elements and each element is scored individually, leading to a final score between 0 and 100.

Final Scoring

This score reflects how fundamentally attractive we believe Broadcom is as an investment, ranging from:

🔴 Below 50 → Uninvestable

🟠 50 - 59 → Questionable

🟡 60 - 69 → Reasonable

🟢 70 - 79 → Quality

🔵 80 - 89 → High-Quality

🟣 90 or above → Exceptional

Unlock our scoring framework and full fundamental analysis below, and see how we score Broadcom on a scale from 0 to 100 — exclusively available to our paid members! ✨